In a milestone move, Satrix is bringing to market the listing of the Satrix MSCI World Feeder ETF (NSE Code: SXKWDM) on the Nairobi Securities Exchange (NSE) on Wed 16 July 2025.

This fund offers local investors a slice of the global stock market pie. It’s like owning tiny fractions of tech giants, energy firms, and healthcare leaders from more than 20 countries

This article breaks it all down:

What exactly is the Satrix MSCI World ETF? How does it work? And more importantly, what’s in it for the everyday Kenyan investor looking to diversify beyond telecoms, and banking stocks?

What is an ETF?

Before diving into the specifics of the Satrix MSCI World ETF, it’s important to understand what an Exchange-Traded Fund (ETF) actually is.

An ETF is a type of investment fund that’s traded on a stock exchange, just like individual company shares. But instead of owning one single stock, an ETF holds a basket of assets like shares, bonds, or commodities, giving investors a ready-made diversified portfolio.

Why do ETFs appeal to investors?

Diversification: By spreading your investment across various sectors and companies, ETFs reduce the risk that comes from betting too heavily on one stock.

Flexibility: Unlike traditional mutual funds, ETFs can be bought and sold throughout the trading day. That means Kenyan investors can react quickly to market movements, whether via a broker or online platform.

Cost-effectiveness: Most ETFs have lower management fees compared to actively managed funds, making them a more budget-friendly option for long-term growth.

Think of an ETF like a matatu. Each passenger represents a company. Some are riding the full route, some hop off early, some join mid-trip. They all pay different fares depending on how far they’re going.

The tout doesn’t care who’s paying the most or least, he’s just collecting a bit from each and getting everyone moving. As the investor, you’re not betting on any one passenger-you’re riding with the whole crowd.

What Is the MSCI World Index?

Imagine walking into a compound where every type of car is parked.

There’s a German-engineered Mercedes, a rugged American Ford, a sleek Japanese Toyota, a classy British Range Rover, and even an electric Tesla in the corner.

Owning just one key gives you access to all of them. That’s what investing in the MSCI World Index feels like.

It’s a widely respected benchmark that tracks the performance of over 1,500 large and mid-sized companies across 23 developed countries, including the U.S, UK, Germany, Japan, and Canada.

These companies span a variety of sectors: technology, healthcare, finance, consumer goods, and more.

Satrix MSCI World ETF:

The Satrix MSCI World ETF, which will be listed on the Nairobi Securities Exchange (NSE), offers Kenyan investors a simple way to gain exposure to global equities through a single, locally traded investment.

This ETF is designed to mirror the MSCI World Index, which includes over 1,500 companies from 23 developed markets.

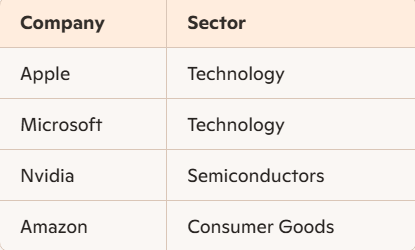

Top Holdings in the Fund Include:

These are among the most influential companies shaping global markets, making this ETF particularly appealing for long-term investors seeking solid international exposure.

Sector Breakdown

Technology – powering innovation and digital infrastructure

Finance – global banking, investment services, and fintech

Healthcare- pharmaceuticals, biotechnology, and medical devices

Consumer Goods-everyday essentials and luxury brands

The Satrix MSCI World ETF lets Kenyan investors ride alongside the global giants without needing a foreign broker, a dollar account, or passport stamps and doing all that in your home turf.

Benefits

‘’The Satrix MSCI World Feeder ETF gives investors exposure to global developed market equities via a single investment. By providing exposure to international companies, local investors are now for the first time, on NSE, able to diversify their investment portfolio to include global markets.‘’ Yusuf Wadee, Head of Exchange Traded Products at Satrix, pointed out.

‘’The ETF adds diversification by giving exposure to 23 Developed Markets. As an index tracking fund this ETF provides this exposure by tracking the performance of the MSCI World Index – A benchmark index that is commonly used globally as the measure of global developed market equity performance.

The Satrix MSCI World Feeder ETF delivers exposure to the index via a single purchase thus unlocking the opportunity for investors to spread their currency risk, across different countries – all while being able to buy and sell this ETF on the NSE via their stock broker.

The Satrix MSCI World Feeder ETF also offers a currency hedge to investors – which means local investors are protected in times of Kenyan Shilling weakness. Individuals will not be subject to any exchange control processes since they are investing in global ETFs on the NSE in Kenyan Shilling (KES). Strcuturally the ETF tracks the index using the iShares Core MSCI World UCITS ETF.’’ He added.

Open ended structure

An open-ended ETF, like the Satrix MSCI World ETF, has the flexibility to issue or redeem units based on investor demand. This means:

– When demand increases, the issuer (Satrix) can create more units by purchasing more of the underlying assets (those global stocks)

– When demand falls or investors exit, they can reduce the number of units by selling off holdings accordingly

This structure helps keep the ETF’s market price closely aligned with the actual value of the assets inside (called the Net Asset Value or NAV). It also ensures there’s:

– Better liquidity for investors

– Minimal price distortion from oversupply or scarcity of units

– A mechanism for expansion as more retail investors enter the market

In simpler terms: If the ETF were a nyama choma stall, and more people showed up hungry, the owner would throw more meat on the grill. Fewer people? Less meat. But everyone gets their serving at a fair price.

How to Get Started with the Satrix MSCI World ETF

Since the Satrix MSCI World ETF will be listed on the Nairobi Securities Exchange (NSE), buying into global markets is now as simple as purchasing any other Kenyan stock.

Step 1: Open a CDS Account

You’ll need a Central Depository System (CDS) account-this is the wallet where your stocks and ETFs are held. You can open one through:

– Your preferred stockbroker or investment bank

– Online platforms such as Dosikaa.

Step 2: Place Your Order

If you already have a CDS account, you can buy units of the ETF the same way you’d buy Safaricom or Equity shares-just search for the Satrix MSCI World ETF ticker on your platform and place an order.

As Justus Ogalo, Head of Derivatives at NSE, puts it, “For those who have active CDS accounts, they can purchase the ETF by placing an order through their existing platforms as they do for other shares.”

Step 3: Understanding the Costs of Investing in the Satrix MSCI World ETF

Investing in ETFs is cost-effective compared to most actively managed funds. ‘’The ETF is offered at a Total Expense Ratio (TER) of 0.35% per annum. In this regard the Satrix MSCI World Feeder ETF is positioned as one of the most cost effective ways for investors to get exposure to global markets in a simple and efficient manner’’ Yusuf Wadee, Head of Exchange Traded Products at Satrix added.

1. Total Expense Ratio (TER) – 0.35% annually

– This is a built-in fee that covers fund management and operational costs.

– For every KES 10,000 invested, KES 35 goes toward managing the fund each year.

– TER is deducted automatically from the ETF’s performance.

2. Brokerage Fees

– When you buy or sell the ETF through a stockbroker, you’ll pay a brokerage commission, typically ranging from 1.5%-2.1% of the transaction value.

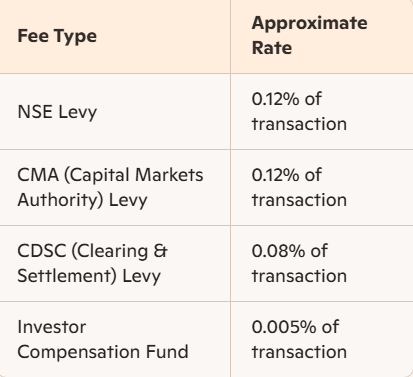

3. NSE Statutory Charges

These include mandatory fees set by the Nairobi Securities Exchange:

Total Estimated Charges on Transaction:

Expect about 2-2.5% total cost when buying or selling the ETF, depending on your broker.

For instance, If Dennis buys KES 100,000 worth of the ETF:

– Brokerage fee (2%) – KES 2,000

– Statutory fees (0.25%) – KES 250

– Annual TER (deducted from returns) – KES 350

So initial transaction costs total around KES 2,250, and he pays KES 350 per year to hold the ETF.

Taxation

”The ETF is structured as an Equity South African registered collective investment scheme. Tax treatment will thus follow principles for similar instruments. The specific tax treatment however of the Satrix MSCI World Feeder ETF for Kenyan investors will vary depending on the tax status of the investor in question. Investors are always advised to seek their own professional tax advice.’’ Wadee added.

The Satrix MSCI World Feeder ETF is structured as an equity collective investment scheme registered in South Africa.

It follows tax principles applicable to South African-listed ETFs.

Distributions or gains within the fund may be subject to South African tax frameworks (e.g. withholding tax on foreign dividends)

However, for Kenyan investors, the tax impact will depend on your individual tax status and:

- Whether you’re investing as an individual or corporate entity

- How Kenya treats foreign-sourced income or gains under its tax laws

- Applicable double taxation agreements between Kenya and South Africa (if any)

Risks and Considerations

While the Satrix MSCI World ETF presents an accessible path to global diversification, it’s important for Kenyan investors to understand the potential risks involved:

- Market Volatility

Global stock markets can experience sharp ups and downs due to geopolitical tensions, economic shifts, interest rate changes, or sector-specific movements. These fluctuations can affect the ETF’s overall performance, just like any other equity investment.

- Currency Risk

Since the ETF is composed of assets denominated in foreign currencies (like USD, EUR, JPY), any movement in exchange rates between these currencies and the Kenyan Shilling can either enhance or erode the value of your investment, even if the underlying stocks perform well.

- Tracking Error

The ETF aims to replicate the performance of the MSCI World Index, but it may not match it exactly. Reasons for this could include management fees, timing of trades, or structural limitations.

This gap between the ETF’s actual returns and the index it’s meant to follow is known as tracking error.

A Vision for Broader Participation

As part of its long-term strategy, the Nairobi Securities Exchange (NSE) aims to bring 9 million retail investors into the fold of the stock market.

According to Justus Ogalo, Head of Derivatives at NSE, “Products such as ETFs create a simple way for retail investors to benefit from investment products that are professionally managed and offer alternative investment opportunities.”

He emphasizes the growing appeal of global stocks and the role that locally listed ETFs can play in opening doors:

“Such products allow local investors to participate in these markets with the benefit of being served at home. More ETFs tracking different securities create diversity and accommodate different investor needs, offering cost-effective opportunities to the market.”