It was a week of mixed signals across Africa’s equity markets; some bullish flickers, a few defensive pivots, and a whole lot of MTN Ghana. If you were hoping for synchronized optimism, you’ll have to wait.

The continent’s exchanges danced to different tunes, with Ghana turning bearish, Rwanda riding Bralirwa’s sugar high, Nigeria leaning on its heavyweights, Kenya drifting politely, and Malawi slipping on telecom and banking weakness.

Ghana Market

Trading activity on the Ghana Stock Exchange turned decisively bearish. Total share volume dropped 25% to 33.3 million shares, down from 44.2 million the previous week. Value traded fell 20%, settling at GH₵151.3 million versus GH₵189.2 million prior suggesting not just fewer trades, but fewer high-value ones.

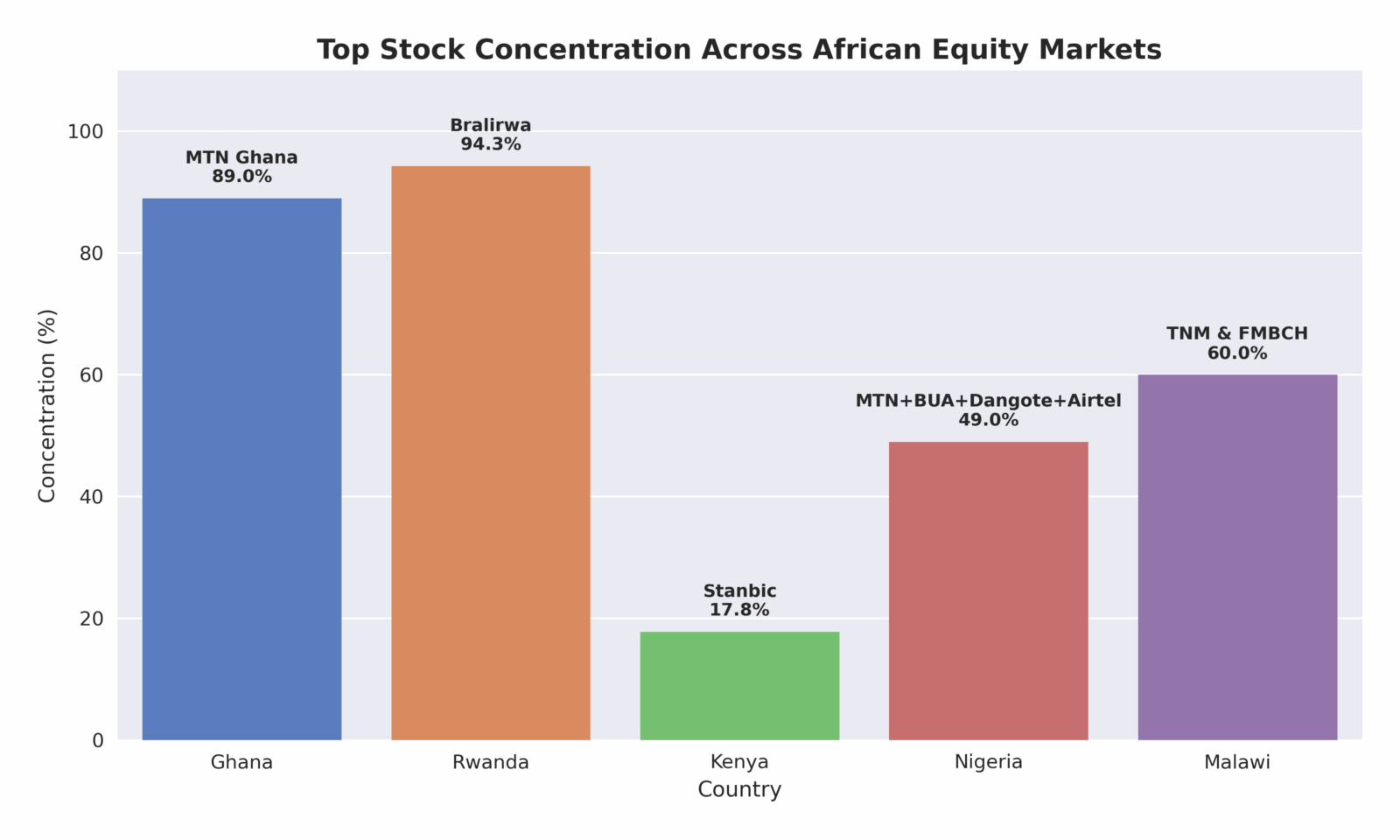

And yet, MTN Ghana (MTNGH) was everywhere. The telco accounted for nearly 89% of total volume, trading 29.6 million shares at GH₵4.20. CAL Bank followed with 1.76 million shares at GH₵0.70, while GCB Bank moved just over a million shares at GH₵22.00. SIC and ETI rounded out the top five, but their volumes were modest.

It’s hard to call this a diversified market when one stock dominates the tape. MTN is the monolith everything else is just noise.

Rwanda Market

Rwanda’s equities market had a good week. The Rwanda Share Index (RSI) rose 2.7%, while the All Share Index (ALSI) gained 0.5%. The driver? Bralirwa, the beverage giant, which surged 5.6% and accounted for 94.3% of market turnover.

Yes, 94.3%. That’s not a typo.

Turnover fell sharply to Frw 155.6 million from Frw 460.2 million the week before, but Bralirwa’s rally was enough to lift the indices. The RSI and ALSI are now trading at weighted P/E ratios of 5.0x and 3.3x respectively. Cheap by global standards, but perhaps reflective of the market’s narrow breadth.

Nigeria Market

The Nigerian Exchange (NGX) lost some steam, with the All Share Index (ASI) slipping 37bps to 165,512.18 points. The Model Equity Portfolio (MEP) declined 27bps, keeping pace with the broader market. Year-to-date, the MEP has returned 6.34%, nearly identical to the ASI’s 6.36%.

But the real story is concentration at the top. MTN Nigeria (14.6%), BUA Foods (13.6%), Dangote Cement (12.4%), and Airtel Africa (8.1%) together account for nearly half the portfolio. Zenith Bank (4.4%) and Stanbic (1.6%) add to the banking ballast. Gains in Aradel Holdings (+3.7%) and Zenith (+1.65%) helped offset losses in Fidelity (-5.7%), Dangote Sugar (-4.2%), and International Breweries (-7.0%).

Nigeria isn’t a one-stock market like Ghana or Rwanda, but it’s still a heavyweight club. When the giants tread water, the index does too.

Kenya Market

Kenya’s market closed on a mixed note. The NASI and NSE 25 rose 0.4% week-on-week, while the NSE 20 edged up 0.3%. The N10 eased by 0.3%.

Market activity rose to USD 22.8 million, up 26.5% from the previous week. Stanbic dominated turnover, accounting for 17.8% of the week’s trades. Its price eased 1.0% to KES 198.00, suggesting that dominance doesn’t always mean upward momentum.

Malawi Market

The Malawi All Share Index (MASI) declined 1.04% week-on-week, closing at 591,983.80 points from 598,180.06. The drop was driven by losses in TNM and FMBCH, two counters that have been under pressure amid broader market softness.

The Continental Pulse

Africa’s equity markets this week were a study in fragmentation. Ghana’s bearish turn was masked by MTN’s volume dominance. Rwanda rode a single stock to index gains. Nigeria leaned on its heavyweights, balancing winners and losers. Kenya’s turnover rose, but price action was muted. And Malawi slipped quietly on telecom and banking weakness.

If there’s a theme here, it’s concentration. Whether it’s MTN in Ghana, Bralirwa in Rwanda, or Nigeria’s quartet of giants, the continent’s exchanges are still defined by a handful of heavyweights. That’s not necessarily bad, but it does mean that when those names move, everything else follows.