Across the continent, equity markets offered a mixed bag of performances last week. Some indices marched upward with bullish conviction, while others stumbled under the weight of waning investor sentiment.

Kenya: Market Closes in the Green, Safaricom Leads Turnover

The Nairobi Securities Exchange (NSE) ended the week on a positive note, with all major indices posting gains:

- NASI: +1.4% w/w

- NSE 10: +1.5% w/w

- NSE 20: +1.3% w/w

- NSE 25: +1.7% w/w

Market activity, however, eased to USD 15.6 million (-28.4% w/w). Safaricom remained the most traded counter, accounting for 28.2% of turnover. Its share price rose 1.0% w/w to KES 26.25, reflecting sustained investor interest.

Rwanda: BK Group Supports Indices Amid Turnover Slump

Rwanda’s equities market edged higher:

- RSI: +0.5% w/w

- ALSI: +0.1% w/w

BK Group led the charge with a 1.5% gain, lifting YTD returns to 4.7% (RSI) and 1.2% (ALSI). However, market turnover fell 64.6% to Frw 64.1 million. Trading was concentrated in Bralirwa and I&M Bank Rwanda, which accounted for 49.7% and 41.0% of turnover, respectively.

Ghana: Bearish Sentiment Hits Volumes and Market Value

The Ghana Stock Exchange (GSE) saw a steep decline in trading activity:

- Share volume: -97% w/w to 10.9 million shares

- Traded value: -83% w/w to GH₵47.16 million

Despite the slowdown, market capitalization rose 3.21% w/w to GH₵150.83 billion, up from GH₵146.13 billion. The gain suggests resilience in listed company valuations, even as high-value transactions tapered off.

The GSE Composite Index previously posted a 0.62% gain, with financial stocks up 1.58%.

Nigeria: Bullish Momentum Sustained, MEP Trails ASI

Nigeria’s equities market extended its bullish streak:

- ASI: +3.18% w/w to 145,754.91 points

- MEP: +2.20% w/w

While the MEP underperformed the ASI by 98bps, its YTD return climbed to 44.11%, maintaining a 250bps lead over the ASI’s 41.61%. Investor appetite remains strong, with momentum favoring large-cap counters.

Malawi: MASI Surges on Broad-Based Gains

The Malawi All Share Index (MASI) soared to 425,534.71 points, up from 393,087.82 the previous week. The rally was driven by share price gains in FDHB, STANDARD, NITL, AIRTEL, and NBS. Investor confidence was buoyed by strong earnings outlooks across key counters.

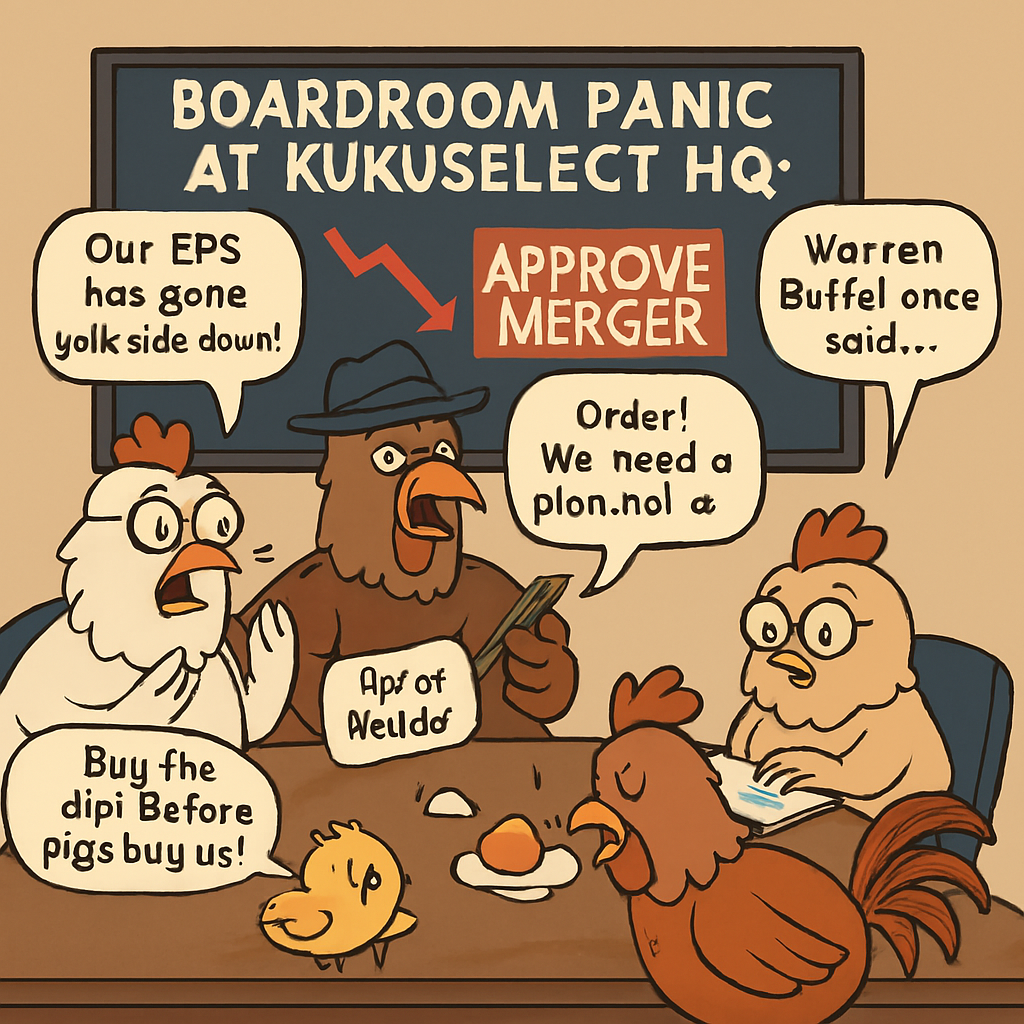

Beyond the Closing Bell: Boardroom Panic at KukuSelect HQ

The executive coop was in chaos.

Kari’s surprise selloff had tanked KU25. FeatherFlow’s merger alert blinked ominously on the wall-mounted dashboard.

Cluckston, the CFO hen, clutched her spreadsheet and gasped,

“Our EPS has gone yolk-side down!”

Mbogo, a turkey in a hedge fund hat, smashed his calculator and squawked,

“Buy the dip! Before the pigs buy us!”

Chairhen Ndunge banged the cornwood gavel with authority,

“Order! We need a plan, not a panic!”

In the corner, Winnie the Layer, strategic analyst and certified fluffball, adjusted her glasses and whispered,

“Warren Buffet once said, ‘Be greedy when others are fearful. But I’m just… mostly fearful.”

Silence fell. Only the soft hum of FeatherFlow recalibrating filled the room.

Then it spoke.

“Board resolution: Approve merger. PigSty Fund is outperforming. KukuSelect losing market dominance.”

Everyone froze.

One rogue chick fainted. A rooster cracked an egg-no symbolism, just stress snacking. The coop had never felt colder.