Let’s begin with the obvious: markets moved. Some up, some down and some sideways. Investors did what investors do; buy, sell, panic, repeat.

In Kenya, the Nairobi Securities Exchange (NSE) had a good week as well as in Malawi. In Nigeria, the NGX had a bad one. Rwanda politely declined to participate. Ghana ghosted and so on…

Kenya’s stock market

This week, the Nairobi Securities Exchange decided to be optimistic. The NSE 20 rose by 3.2% week-on-week, the NASI by 1.5%, and the N10 and NSE 25 by 1.4% each.

Market activity also rose, reaching USD 23.5 million. Safaricom, the NSE darling, dominated market activity accounting for 45.9% of the week’s turnover. Safaricom’s price nudged up 1.2% to KES 28.60.

Rwanda’s stock market

Meanwhile, in Rwanda, the market did not move. The Rwanda Share Index and the Rwanda All Share Index remained muted, which is a polite way of saying “nothing happened.” No stocks made significant gains.

Monthly equities turnover fell by 1.83% to Frw 256.9 million, which is less than July but still more than zero. Weekly turnover, however, jumped 48% to Frw 112.4 million, almost entirely thanks to BK Group, which accounted for 98.8% of market activity.

Nigeria’s stock market

In Nigeria, the NGXASI fell 0.50% week-on-week, marking its third consecutive week of losses. The MEP also declined by 0.75%, underperforming the benchmark by 25 basis points, which is the financial equivalent of tripping over your own shoelaces while trying to win a race you were already ahead in. Still, year-to-date, the MEP is up 38.66%, outperforming the NGXASI’s 36.31% by 235 basis points, which means it’s losing less enthusiastically.

The underperformance was blamed on overweight positions in ZENITHBANK (-5.71%), GTCO (-2.13%), and WAPCO (-3.38%), which collectively shaved 50 basis points off returns. STANBIC, which rose 6.38%, gave the benchmark index a smug little boost.

Malawi’s stock market

In Malawi, the market was bullish. The MASI closed the week at 535,303.19 points, up from 490,201.45 the week before. Gains in NICO, NBM, STANDARD, FMBCH, NBS, and BHL drove the rally, while TNM and FDHB tried to ruin the party but were politely ignored.

Ghana’s stock market

And finally, Ghana. The market turned bearish, which is a polite way of saying “everyone left early.” Share volume dropped by 83%, from nearly 13 million shares to just 2.15 million.

Traded value fell by 67%, settling at GH₵15.51 million, which is less than GH₵47.11 million and also less fun, unless you enjoy watching liquidity evaporate in real time.

Market capitalization dipped by 0.20%, closing at GH₵149.60 billion, down from GH₵149.90 billion.

Beyond the closing bell

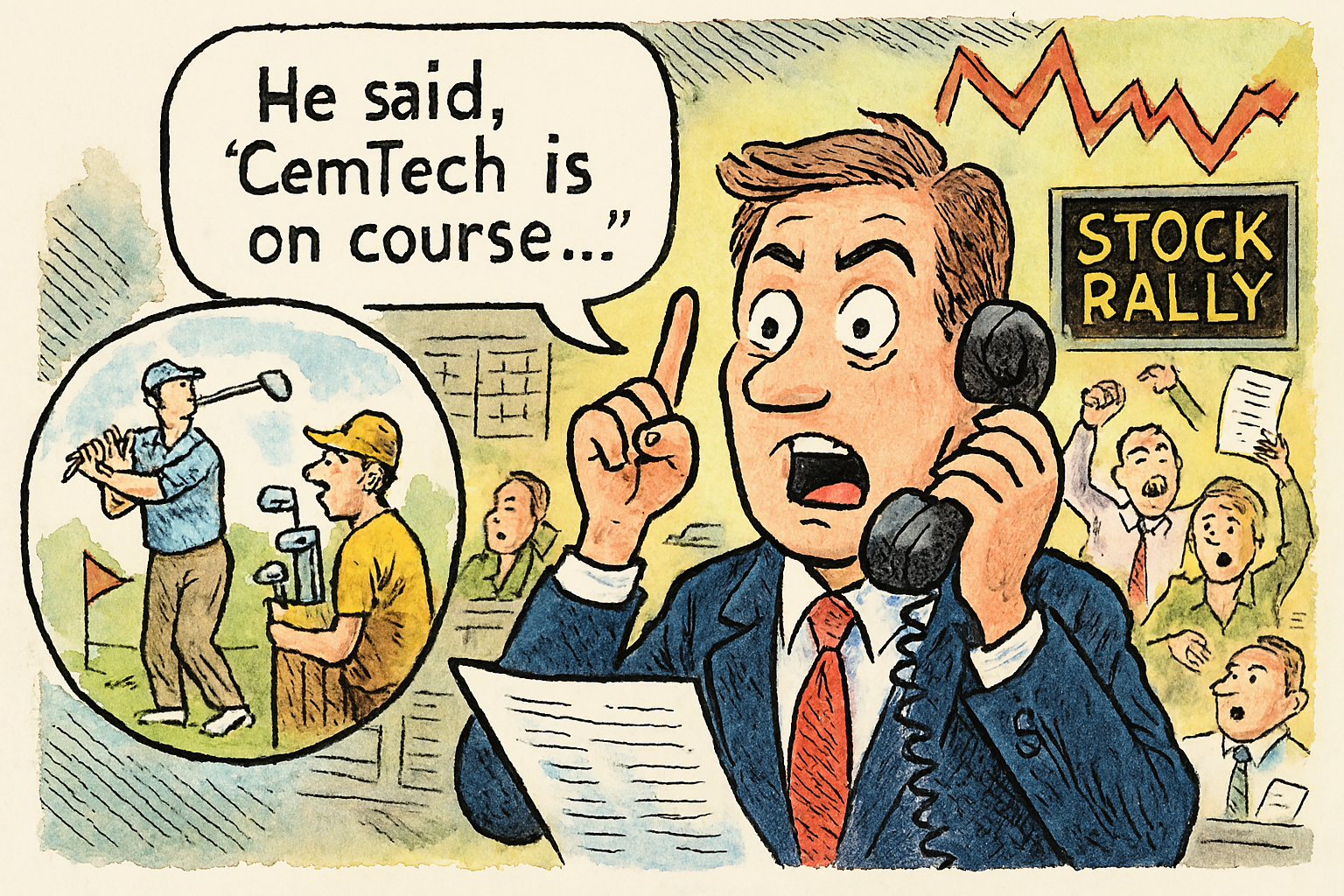

The Whisper at the 9th Hole

In finance, information is supposed to be valuable. But sometimes, half-information whether misheard, misquoted, misinterpreted is even more valuable. Especially when it’s passed through a WhatsApp group of self-taught market enthusiasts. The WhatsApp warriors. The X-formerly-Twitter tacticians. They are legion. They are loud.

Their research process? A cousin in CMA, a YouTube video titled “How to Spot Insider Moves”, and a screenshot that says “BUY BUY BUY.” They are not constrained by valuation. Or reality.

This week, Retail Alpha KE, a WhatsApp group where market rumors go to become gospel moved one stock violently upward. Not because of earnings. Not because of filings. Because of a whisper. From a golf course.

Benji, a part-time trader and full-time delivery guy, was dropping off supplies at Muthaiga Golf Club. At the 9th hole, a group of investment bankers were deep into a round of Texas Scramble.

Benji overheard one line while handing over a crate of sparkling water:

“CemTech… might be worth watching.”

What he missed because he left to chase a tip was the rest:

“…if you enjoy watching bad stocks burn slowly.”

To Benji, overhearing a banker mid-swing is equivalent to insider research. By evening, he posted in Retail Alpha KE, “Heard top bankers whispering about CemTech. Something’s brewing.”

Screenshots of CemTech’s Flash-era website circulated like sacred scrolls. Someone claimed to have seen a cement truck near the old factory. The stock surged 38% on no news, no earnings, and no pulse.

Then came the institutional silence. No analyst notes. No filings. Just a vacuum. And in markets, a vacuum is louder than hype.

By Thursday, CemTech wobbled. By Friday, it crashed down 62%. The WhatsApp warriors posted “BUY or HOLD”. But the stock kept dipping.

Benji’s final post:

“Markets are irrational. CemTech was manipulated. I’m out.”

And so CemTech returned to dormancy. The whisper faded.