Across Africa, fintech is no longer just about mobile money and payments. A new generation of

platforms is emerging that speaks the language of capital markets, wealth management, and

institutional-grade investing.

AlgoHive’s Entry into South Africa’s Investment Landscape

In South Africa, a new fintech platform called AlgoHive has launched with a clear proposition:

retail investors can access fund-grade investment strategies without paying traditional

management fees. The firm, licensed by the Financial Sector Conduct Authority under Category

I and Category II, offers a “super wealth” app that blends curated portfolios, personal finance

tools, and investment-backed lending in one digital interface.

A Closer Look at the Platform’s Structure

At first glance, this might look like another iteration of the robo-adviser trend. Viewed more

closely, AlgoHive’s model reflects a broader shift in how financial services are being delivered

in the digital age. Users can subscribe to strategies that are run with fund-like rigour, compare

spending patterns to anonymised peers, and, subject to prudential limits, borrow against eligible

portfolios. The aim is to expand access while reducing the frictions and minimums that often

exclude everyday investors.

Features and Fee Model

The platform offers curated investment strategies across multiple asset classes, including digital

assets, spend tracking and insights, investment-backed credit, and access to independent financial

advisers. It does this without charging traditional assets under management fees on the strategies

that clients choose to subscribe to.

“We run each strategy with the same discipline you would expect from a fund, but we make it

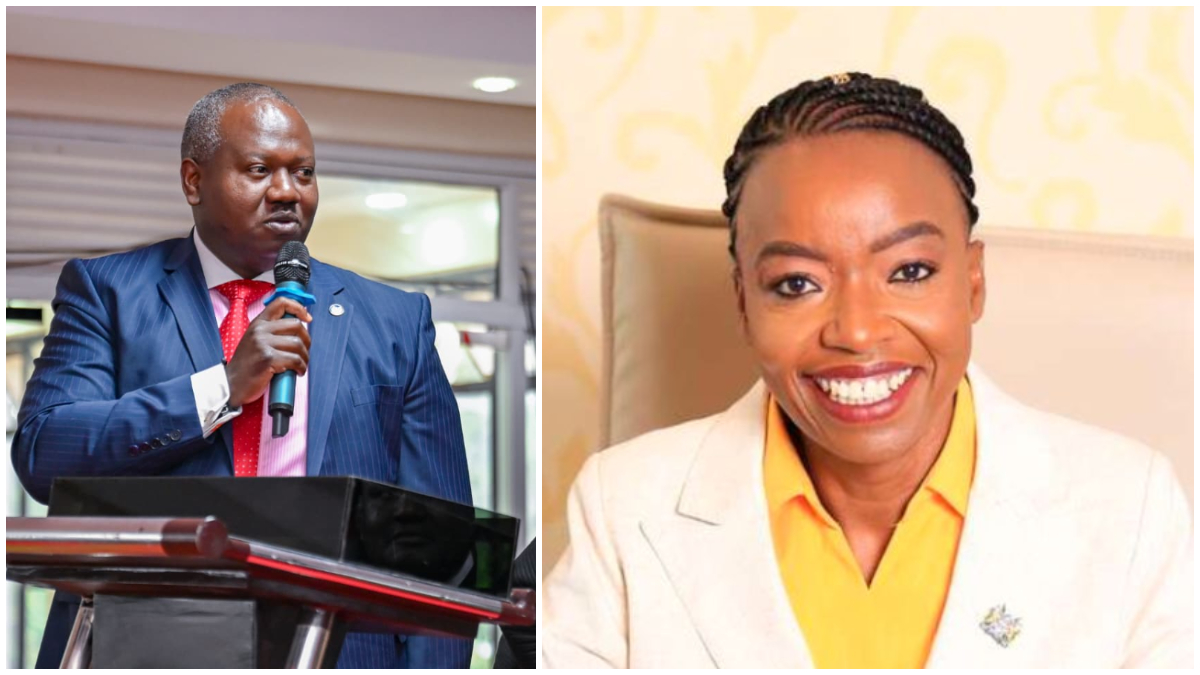

simpler and more affordable to access,” says Lonwabo Damane, CEO and co-founder of

AlgoHive. “By removing AUM fees and bringing strategy management, insights, and personal

finance tools into a single experience, we are making investing smarter, fairer, and easier to use.

Clients can choose open strategies across asset classes, and in time they will also be able to

invest in funds listed on the platform, compare options side by side, and decide what suits them

best.”

Questions remain, and they are important ones. How sustainable is this model over the cycle.

What happens when strategy performance lags or credit risk rises. How will regulators respond

to the continued blurring of investing, borrowing, and advice. AlgoHive’s team argues that

sustainability rests on disciplined mandates, transparent real-time factsheets, and conservative

loan-to-value limits for investment-backed credit, all within existing FSCA and NCR

frameworks.

”AlgoHive is a licensed South African platform that hosts institutional-grade investment strategies, not copy trades for retail investors. We provide real-time factsheets, strict risk limits, and low, transparent fees. When performance dips, clients see it immediately and can switch strategies or choose listed funds on the same platform.” Said Lonwabo. ”For investment-backed credit, we’ll mirror local best practice – conservative LTVs, liquid collateral, and NCR-compliant agreements – similar to securities-based lending already available in SA. We believe regulators will support greater access with stronger guardrails: licensed activity under FAIS, proper disclosures, and robust market-conduct controls.” He added.

Why Fintech Adoption in Capital Markets Matters

Widespread adoption of fintech in capital markets is increasingly necessary. It has the potential

to deepen financial inclusion, improve market liquidity, and foster a culture of informed

investing across the continent. For this promise to be realised, regulators, institutions, and

investors will need to embrace the shift not as a threat to tradition, but as a catalyst for

transformation.