Centum Investment Company Plc saw its consolidated net profit tumble by 68.8% year-over-year, dropping from KES 2.6 billion to KES 812.8 million. But this wasn’t purely operational, it was largely driven by non-cash accounting adjustments.

The company reported a -46.7% drop in revaluation gains on its real estate assets, indicating softer property market sentiment or more conservative valuations. Additionally, a tax-related hit emerged from asset reclassifications and a change in the deferred tax rate on non-sale investment property, from 5% to 15%.

Despite a sharp drop in net profit, Centum Investment Company Plc found a bright spot in its financials through gains in other areas. The firm booked KES 2.5 billion in other comprehensive income, mostly from positive revaluations in its unquoted investments.

However, not all of that gain trickled down to shareholders. A loss of KES 434.9 million was absorbed by non-controlling interests (minority partners in subsidiaries), which left Centum’s shareholders with an attributable comprehensive income of KES 3.7 billion-still a solid +34.8% growth compared to the previous year.

Centum’s real estate portfolio

Centum’s real estate portfolio delivered a mixed performance in the latest period. TRIFIC SEZ (Two Rivers Special Economic Zone) saw its profitability shrink by 97.0% year-on-year, landing at KES 88.4 million, while Centum Real Estate’s net earnings halved to KES 1.5 billion.

On the upside, losses from the Two Rivers Development project narrowed sharply-down 74.9% to KES 242.7 million, signaling improved operational efficiencies or better asset use.

In terms of land transactions, the company has collected KES 6.7 billion from sales, representing 78% of the KES 8.6 billion in cumulative deal value. Management highlighted that bulk land sales-typically priced close to valuation-will taper off, now that the acquisition debt has been settled.

This marks a strategic shift toward value optimization, as future land deals may come with greater pricing flexibility or higher margins.

On the residential side, Centum reported KES 2.7 billion in net cash realizable-the estimated amount receivable from ongoing projects after subtracting costs to completion. This paints a clearer picture of its short-term liquidity position and project viability.

Looking ahead, Centum revealed plans to launch a Dollar-denominated I-REIT for TRIFIC SEZ by FY26, a move that could unlock foreign capital and bolster the project’s appeal to institutional investors seeking structured real estate exposure in East Africa.

Centum’s marketable securities portfolio

Centum’s marketable securities portfolio closed the year at KES 1.9 billion, down from KES 2.8 billion in FY24, following a strategic liquidation of KES 1.2 billion to settle debt and shield the business from rising interest rates.

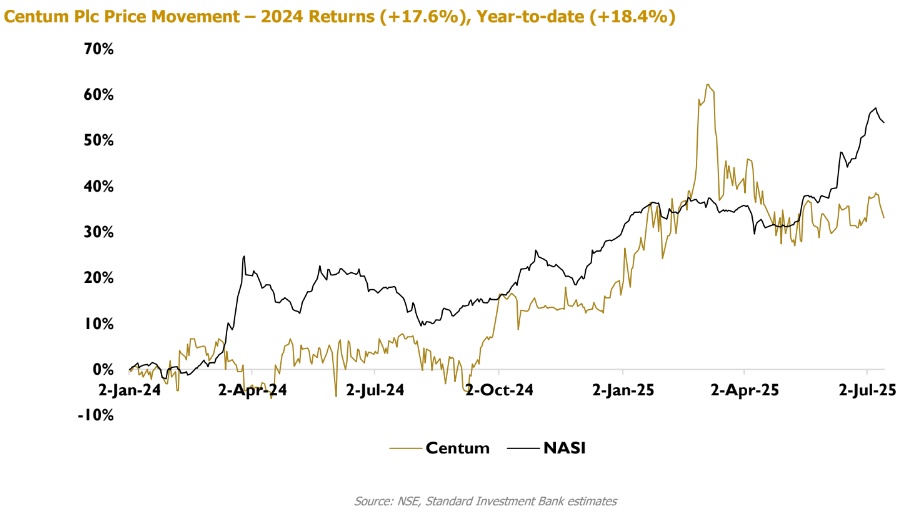

Despite the smaller asset base, the portfolio delivered an impressive 18.5% return, up from 15% in the previous year-showing Centum’s ability to squeeze strong performance from leaner holdings.

However, the move impacted annuity income, which fell 4.3% year-on-year to KES 662 million-a key metric, since dividends are paid from this pool.

Even so, total income rose 17.0% to KES 1.3 billion, buoyed by a 49.3% jump in realized gains thanks to the successful monetization of its stake in Sidian Bank.