In good times and bad, people drink – but in great earnings seasons, they toast.

That sentiment rings true for East African Breweries PLC (EABL), which just uncorked a bubbly set of results for the fiscal year ending June 30, 2025. With profits attributable to shareholders rising 16.2% to KES 9.5 billion and comprehensive income surging 83.9%, the brewer has given investors something worth raising a glass to.

This spirited performance was brewed on the back of two key tailwinds:

- Easing finance cost pressures: Net finance costs dropped 28.3% from KES 8.2 billion in FY24 to KES 6.0 billion in FY25. The decline in short-term government debt yields – with T-Bill rates falling by 783.84bps (91-day), 830.23bps (182-day), and 706.90bps (364-day) – helped lower the cost of servicing loans linked to these instruments. This reversal softened the weighted average interest rate, which had previously spiked to 15.67% in FY24, up from 11.86% in FY23.

- Foreign exchange tailwinds: EABL also benefited from a favorable swing in FX translation differences. What was a KES 4.0 billion loss in FY24 turned into a KES 515.0 million gain in FY25, reported under other comprehensive income. This reversal reflects currency stability across its regional operations and a more favorable translation of foreign subsidiaries.

EABL’s Revenue Growth

While EABL’s bottom-line performance sparkled, top-line growth was more modest, with net revenues inching up 3.8% year-on-year to KES 128.8 billion.

Management attributed this to a 2% volume growth across the region, a notable improvement from +1.2% in FY24 and -7% in FY23, signaling a gradual recovery in consumer demand.

Interestingly, unlike previous years, no price markups were cited as contributors to revenue growth -suggesting that the gains were driven purely by volume rather than pricing strategy. This restraint may reflect competitive pressures or a deliberate pivot toward affordability in a price-sensitive market.

Cost of sales

On the cost side, cost of sales rose 6.2% y/y to KES 74.7 billion, outpacing revenue growth and squeezing margins. As a result, gross profit remained flat at KES 54.1 billion, mirroring the prior year – a sign that while EABL is selling more, it’s not necessarily earning more per unit.

Operating Expenses

Despite inflationary pressures and rising input costs, EABL kept operating expenses on a tight leash, with costs holding steady at KES 28.9 billion, a marginal 0.2% year-on-year increase. This discipline, paired with easing finance costs, helped propel pre-tax profits up 15.2% to KES 19.3 billion.

Following a KES 7.1 billion tax charge, the group reported net earnings of KES 12.2 billion, marking a 12.2% year-on-year growth. Of this, KES 9.5 billion was attributable to shareholders – a 16.2% uplift, and a clear signal that EABL’s cost containment strategy is paying dividends, quite literally.

EABL’s Liquidity Squeeze

EABL may have brewed up strong profits, but its working capital position took a 10.6% dip, sliding from KES 5.4 billion in FY24 to KES 4.9 billion in FY25. The culprit? Current liabilities ballooned 21.2% to KES 43.8 billion, outpacing the 17.9% growth in current assets, which rose to KES 48.7 billion.

EABL’s Valuation

From a valuation lens, EABL is trading at a P/E multiple of 14.7x and a P/B multiple of 6.6x – signaling investor confidence in its earnings power and brand equity. And rightly so: the counter boasts a Return on Equity (ROE) of 45.0% and a Return on Assets (ROA) of 9.3%.

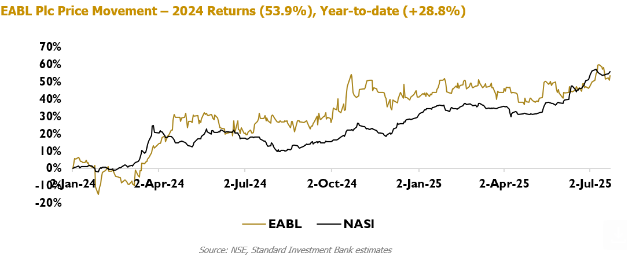

Price Movement

After bottoming out at KES 100.00 on 29th January 2024, the counter rallied to deliver capital gains of 53.9% by year-end, aligning neatly with earlier projections.

Fast forward to 2025, and the momentum continues: Year-to-date (YTD), the stock is up 28.8%, outperforming key indices like the NSE 10, NSE 20, and NSE 25, though still trailing the broader NASI.

Dividend Toast

EABL’s board is popping the cork on a final dividend of KES 5.50 per share, subject to withholding tax, with payment slated for on or about 28th October 2025 and a book closure date of 16th September 20252.

If approved, this will bring the total dividend for FY25 to KES 8.00 per share, a 14.3% uplift from the KES 7.00 paid in FY24.