Markets last week were supposed to be boring. It was a shortened trading week in the U.S. thanks to Martin Luther King Jr. Day, and usually that means fewer headlines, lighter volumes, and a chance for traders to catch their breath. Instead, we got Greenland.

US Markets

On Tuesday, President Trump announced plans to impose tariffs on European countries that opposed U.S. efforts to purchase or gain control of Greenland. Yes, Greenland, the icy landmass that suddenly became a geopolitical bargaining chip. The S&P 500 promptly recorded its largest one-day decline since October, because apparently investors had not modeled “tariffs tied to ice sheets” into their discounted cash flow spreadsheets.

By Wednesday, however, Trump softened his stance. In a social media post, he claimed to have reached a ‘preliminary framework’ with NATO Secretary General Mark Rutte and confirmed that the proposed tariffs scheduled for February 1 would no longer be implemented. Markets, relieved that Greenland was not about to become the next NAFTA, rallied.

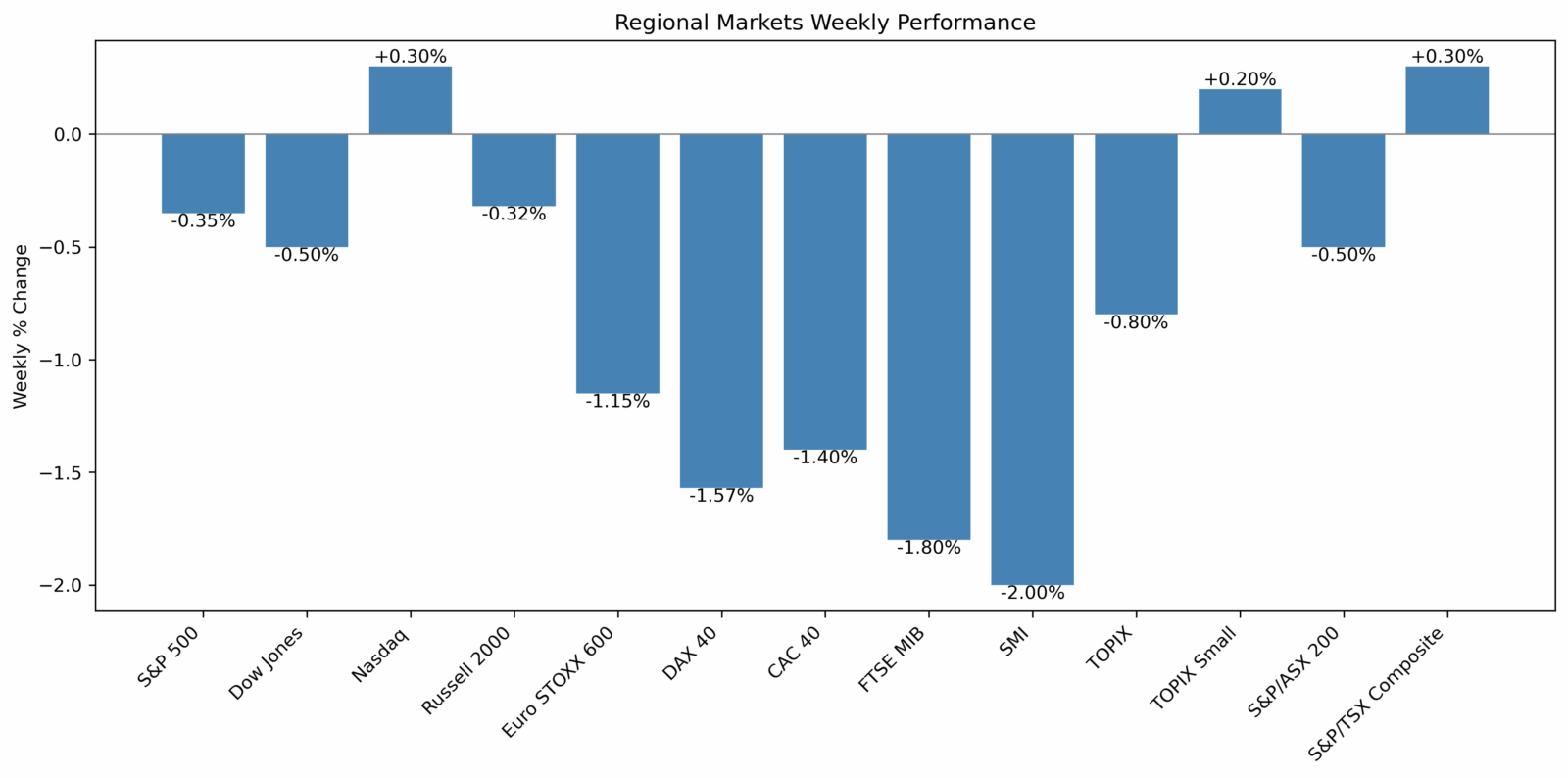

By week’s end, the damage was contained: the S&P 500 slipped 0.35%, the Dow fell 0.5%, and the Russell 2000 edged down 0.32%. The Nasdaq, powered by semiconductors, managed to eke out a 0.3% gain because apparently you can’t tariff Greenland into existence, but you can spook the S&P for a day.

Technology Markets; The Chip Soap Opera

The real drama was in chips. Nvidia rose 0.77% after reports that Chinese officials were preparing orders for its H200 AI chips. AMD surged 12.01%, proving that sometimes being the scrappy underdog pays off spectacularly. Intel, meanwhile, slid 4.02% after issuing a softer-than-expected outlook and highlighting operational challenges. Broadcom dropped 9%, reminding investors that semiconductors are not a monolith but rather a soap opera where one character’s triumph is another’s tragedy.

Financials and utilities dragged the broader market lower, while energy stocks provided a rare bright spot because in markets, one sector’s misery is always another’s moment of glory.

European Markets

Across the Atlantic, Europe had its own rollercoaster. The Euro STOXX 600 fell 1.15%, with Germany’s DAX down 1.57%, France’s CAC 40 off 1.4%, Italy’s FTSE MIB down 1.8%, and Switzerland’s SMI sliding 2.0%. Yet beneath the tariff noise, Germany’s private-sector activity grew at its fastest pace in three months, according to S&P Global PMI data.

Investors were left juggling two narratives: trade tensions versus economic resilience which is basically Europe’s default setting; resilient enough to grow, fragile enough to panic, and always available for tariff drama.

Asian Markets: Japan’s Mixed Signals

Japan’s stock markets were mixed over the week. The TOPIX Index lost 0.8% (6.5% YTD), but the TOPIX Small Index gained 0.2% (6.7% YTD). Domestic political uncertainty weighed on sentiment, and talk of unfunded tax cuts sent JGB yields soaring as investors grew increasingly concerned about the country’s already fragile finances.

The Bank of Japan left interest rates unchanged, as expected, but the market reaction suggested that investors wanted more reassurance than they got. Japan’s markets ended up looking like a haiku about fiscal fragility: small caps up, large caps down, bond yields screaming.

Pacific Markets: Australia and Canada

In Australia, the S&P/ASX 200 Index shed 0.5% (1.7% YTD), dragged lower by the same geopolitical turmoil over Greenland and tariffs that rattled global investors. Canada, by contrast, offered a small dose of optimism: the S&P/TSX Composite advanced 0.3% (4.6% YTD), buoyed by strength in commodities and a relatively calmer political backdrop.

Currencies Markets

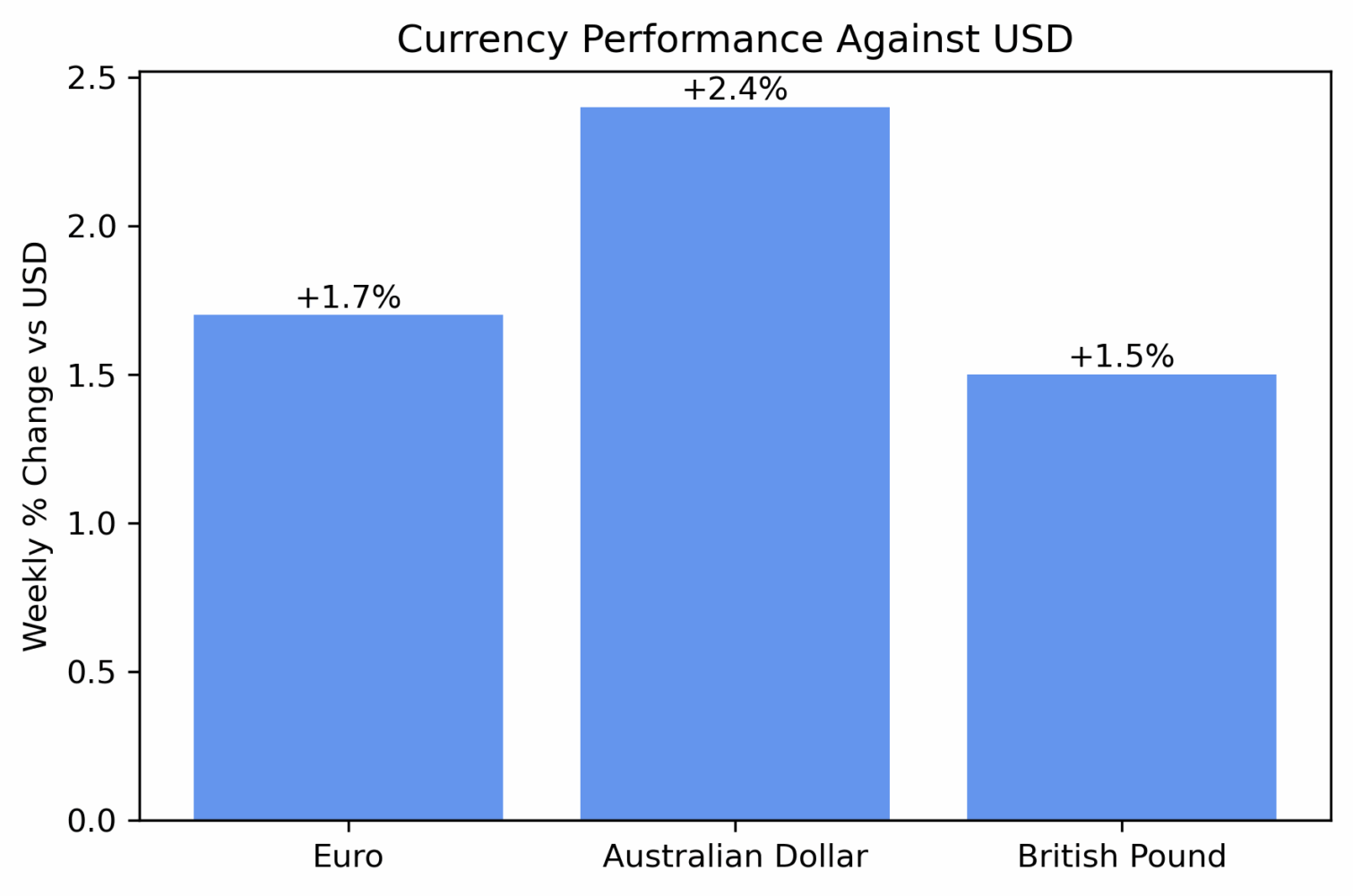

Currencies told their own story. The euro strengthened to USD 1.18, up from 1.16, flexing against the dollar despite tariff turbulence. The Australian dollar rose meaningfully by 2.4% against the U.S. dollar, a move that spoke to commodity-linked optimism.

Sterling climbed to USD 1.36 from 1.34, suggesting that Brexit anxieties were easing or at least that investors had decided the pound deserved a reprieve.

Beyond the bell

So what do we make of all this? Markets last week were a reminder that geopolitics can be as market-moving as earnings reports. Growth stocks are under pressure (-1.0% YTD), while value stocks are quietly outperforming (+3.9% YTD).

Semiconductors remain the sector to watch, (the only sector where a chip shortage can coexist with a chip surplus, depending on which company you ask), but the divergence between AMD’s surge and Intel’s stumble shows that execution matters more than hype.

Europe’s PMI resilience hints at underlying strength, but tariff uncertainty keeps risk premia elevated. And the dollar’s weakness against the euro, pound, and Aussie suggests investors are diversifying away from dollar dominance.

The bottom line: volatility may have been the headline, but beneath it, investors are repositioning or rotating into value, hedging with stronger non-dollar currencies, and waiting to see if Greenland remains a footnote or a fixture in global trade policy.