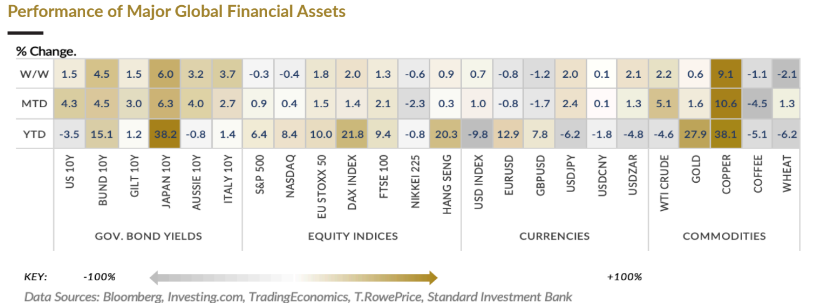

Global stock markets saw notable losses over the past week as escalating trade tensions sent ripples across major economies. U.S. President Donald Trump announced new 25% tariffs targeting key trade partners-South Korea and Japan, citing economic imbalances.

In a surprise move, he also vowed to raise Brazil’s tariff rate to 50%, a decision reportedly tied to the country’s ongoing legal proceedings against former President Jair Bolsonaro. These aggressive, country-specific levies have reignited debates over protectionism, international diplomacy, and market stability.

US Stock Market Review

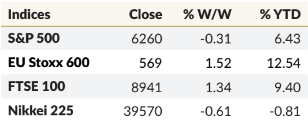

U.S. stock markets closed last week with modest losses, despite briefly touching record highs. The mixed performance across major indices reflected growing investor caution amid renewed trade tensions.

– The S&P 500 dipped 0.31%, while the Nasdaq Composite slipped 0.38%.

– The Dow Jones Industrial Average led the decline, falling 1.01%, shedding nearly 300 points midweek after President Trump announced a 35% tariff on Canadian imports, effective August 1.

– Adding to the unease, Trump floated a broader plan to raise tariffs on most major trading partners to 15–20%, up from the current 10% baseline, intensifying concerns about global trade disruption.

Despite these headwinds, both the S&P 500 and Nasdaq managed to notch fresh record highs during the week, underscoring the market’s resilience.

Europe Stock Market Review

The FTSE 100 had a rollercoaster week, initially retreating from record highs due to a 0.1% contraction in UK GDP for May-its second consecutive monthly decline.

This downturn, driven by weakness in manufacturing and construction, raised fresh concerns about the UK’s economic resilience.

Yet by week’s end, the FTSE 100 rebounded, buoyed by rising gold prices that boosted mining and energy stocks as investors turned to safe-haven assets amid global trade tensions.

The index closed up 1.34%, marking its strongest weekly gain since mid-May

Asia Stock Market Review

Japanese stocks declined over the week following the United States’ announcement of a 25% tariff on Japanese imports, effective August 1, 2025-up slightly from the previous 24%.

This has stirred trade tensions and weighed on several Japanese giants. Key decliners included Toyota Motor Corp (-0.94%), Mitsubishi Heavy Industries (-0.92%), and Sony Group Corporation (-0.31%), all sensitive to export disruptions and sector volatility.

Still, optimism lingered around potential negotiations, and a few diversified firms like NTT Inc (+1.18%) and Hitachi (+1.21%) posted gains, underscoring the resilience of certain pockets of the Japanese economy.