There was a time when adulthood in Kenya was easy and self-explanatory. You bought land. You built a house. You owned a car, even if it was second-hand. You had your own sufuria set, your TV, and your gas cylinder. Ownership was not about showing off. It was about stability.

That idea did not collapse loudly. It faded quietly.

Today, many Kenyans, especially in towns, do not really own things. They access them. And most people did not notice when the switch happened.

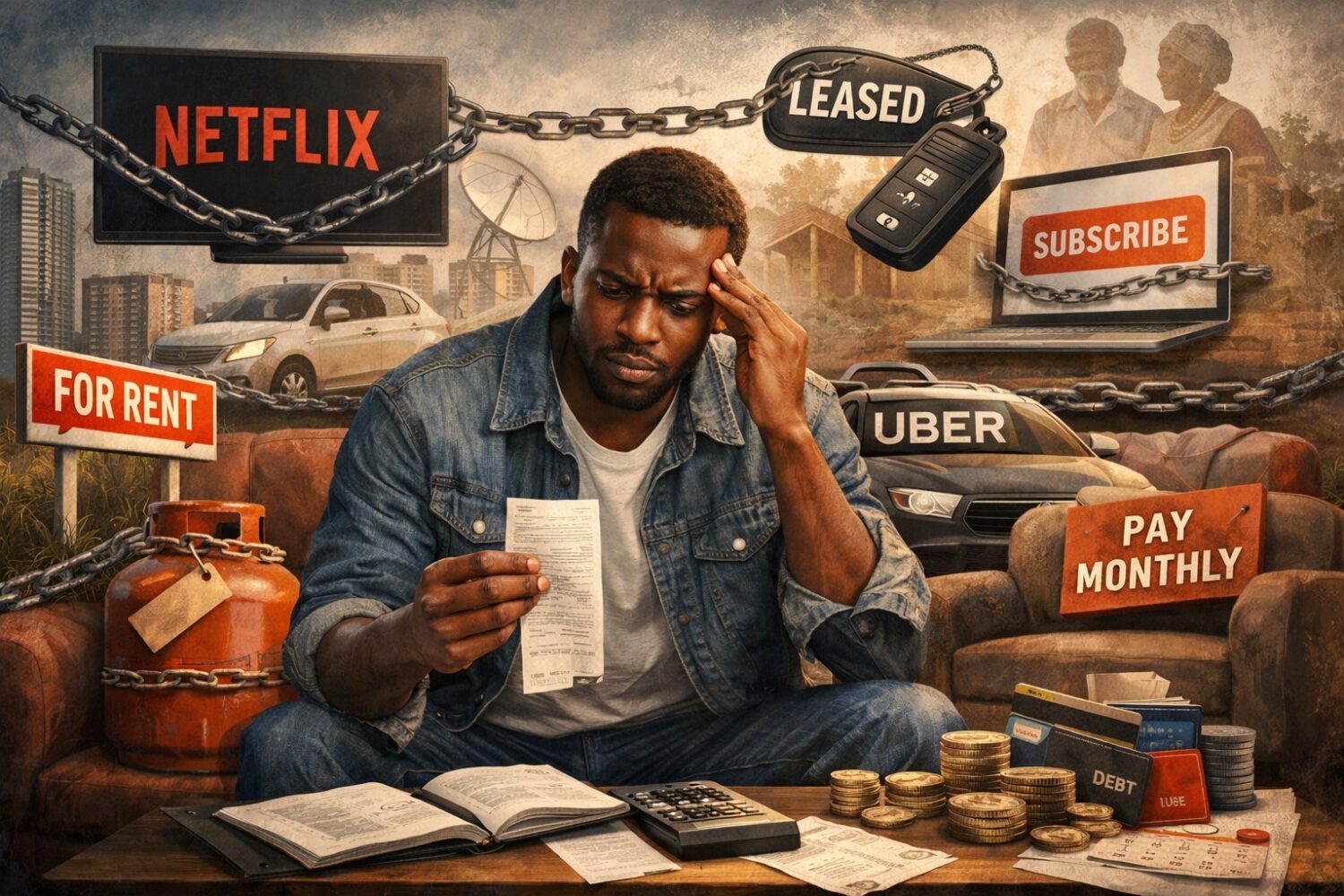

Think about your daily life. That phone in your hand is probably still being paid for in installments. Your furniture? Probably on a monthly payment plan. Your TV, your fridge, and even your laptop could still belong to a financing company. Your music lives on Spotify. Your movies are on Netflix or Showmax. Your work tools are subscriptions. Stop paying, and everything disappears.

Your ride to work is Uber or Bolt. Convenient, yes. But nothing is actually yours.

This is not because Kenyans suddenly forgot how to save. The ground shifted.

Land, once the safest form of Kenyan wealth, has become expensive, risky, and stressful. Fake titles, family disputes, cartels, and endless court cases have turned land ownership into a gamble. Cars, once a dream, now come with fuel prices that keep jumping, insurance costs, repairs, traffic jams, and constant police extortion. Many people have simply done the math and decided it is cheaper and easier to rent movement than to own it.

At the same time, salaries have largely stayed the same while the cost of living keeps rising. Saving for big purchases now takes years. Into this gap stepped credit, installments, and buy-now-pay-later deals. They feel helpful, but they quietly lock people into permanent payments. One plan ends, and another begins. You are always paying.

Globally, companies discovered something important. Selling you something once makes money. Renting it to you forever makes much more. A movie sold once is cheap. A subscription paid monthly never ends. Software that used to be bought once is now rented for life. Kenya has adopted this system faster than many countries have, and without much assessment or discussion.

There is also a hidden mental cost. Ownership gave people a sense of permanence. Even when money was tight, there was something solid you could point to and say, “This is mine.” Renting everything creates silent anxiety. Everything can be switched off, repossessed, increased, or cancelled. You are always one missed payment away from disruption.

This is why many people feel busy but stuck. They are paying for life, not building it.

This shift is not only happening in Kenya. Around the world, younger generations own less than their parents. Homes are expensive. Stable jobs are fewer. Subscriptions have replaced possessions. The difference is speed. What took decades elsewhere is happening in Kenya in just a few years.

The problem is that social expectations have not changed. Parents still ask, “Umenunua shamba? Umenunua gari?” The economy quietly responds, “With what money?”

Ownership is not completely dead, but it is changing. It is becoming a privilege, not a normal milestone. Those who manage to own things are owning fewer but more meaningful assets. Land, housing, and income-generating tools matter more than lifestyle items that can easily be rented.

Renting itself is not the enemy. Convenience has value. The danger is renting everything without realizing the long-term cost. After ten or twenty years of payments, you may discover you have nothing solid to show for it.

The question facing Kenyans today is simple. In ten years, will you own anything, or will you still be paying monthly for the same things? That answer will shape financial security. The shift away from ownership is real. The choice is whether to move through it awake or sleepwalk into permanent dependence.