Kenya Revenue Authority (KRA) will now collaborate with the Kenya National Chamber of Commerce and Industry (KNCCI) to sensitize Micro, Small, and Medium-sized Enterprises (MSMEs) to enhance tax compliance.

The partnership signifies a significant step towards fostering a culture of tax compliance and promoting sustainable business practices within the MSME sector.

Under the collaboration, KRA and KNCCI have agreed to undertake joint tax education programs, including the establishment of tax clinics countrywide, where MSMEs will be offered tax services at their premises.

These initiatives aim to provide MSMEs with the necessary knowledge and support to fulfil their tax obligations effectively.

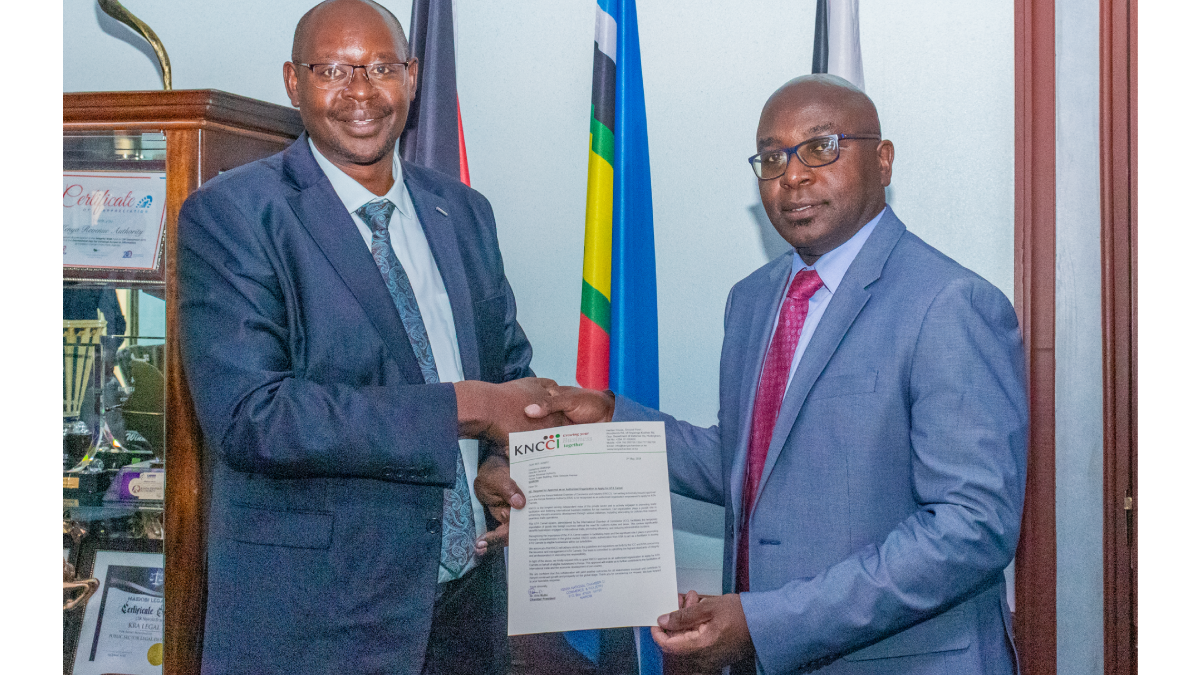

Speaking during an engagement with KNCCI, KRA Commissioner General Mr. Humphrey Wattanga emphasized the importance of collaboration in addressing tax complexities and ensuring sustainable tax base expansion, with a particular focus on the MSME sector.

Mr. Wattanga expressed KRA’s commitment to working closely with KNCCI to rollout outreach programs that will create awareness on tax matters and address the challenges faced by traders.

“We have a committed focus on tackling matters of tax complexity,” stated Mr. Wattanga, highlighting KRA’s dedication to supporting MSMEs in navigating tax-related issues and fostering a conducive business environment.

In addition to enhancing tax compliance, KNCCI will collaborate with KRA in the fight against illicit trade and work towards creating a friendly environment for businesses to operate.

The Chamber will continue its efforts to sensitize its members on the dangers of smuggling, thereby contributing to the overall integrity of the business environment.

KNCCI President Dr. Erick Rutto expressed the institution’s commitment to seeking KRA’s support in sensitizing its members on the Electronic Tax Invoice Management System (eTIMS), further underscoring the importance of leveraging technology to streamline tax processes and enhance compliance.

The collaboration between KRA and KNCCI underscores a shared commitment to supporting the growth and sustainability of MSMEs in Kenya.

By working together, the two institutions aim to empower MSMEs with the knowledge, resources, and support needed to thrive in the evolving business landscape.