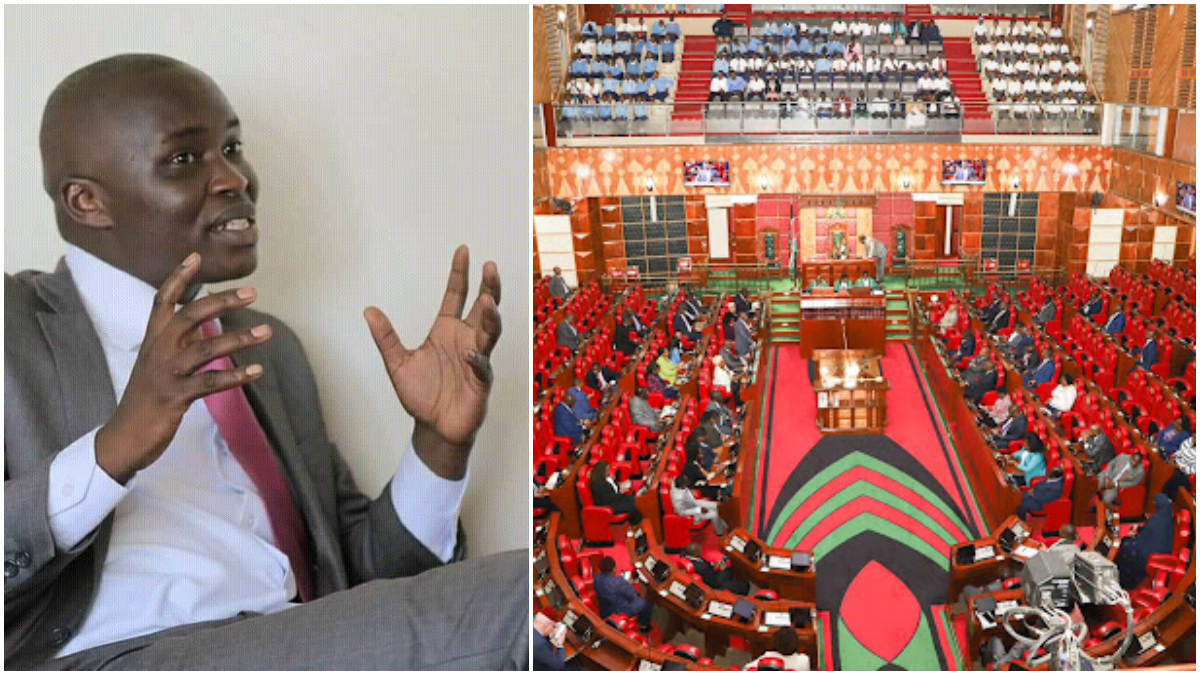

Nandi Hills Member of Parliament Bernard Kitur, together with Dr. Geoffrey Kiprop, have proposed the introduction of a Health Promotion Levy in the Soft Drinks Industry to the National Assembly Departmental Committee on Finance and National Planning.

The duo made the proposal during the ongoing public hearings on the Finance Bill 2025 where they based their recommendations on alarming current trends in consumption of soft drinks by Kenyans, compared to other countries that have regulations that regulate sugar consumption in soft drinks.

They say the purpose of the levy is to combat the rising consumption of sugar-sweetened beverages (SSBs) in Kenya, which has led to increased cases of obesity, diabetes, and other non-communicable diseases (NCDs).

Kitur proposes that the money collected through the levy be used to support public health campaigns and infrastructure as well as school nutrition programs.

The proposal also sets to introduce a CAP that regulates manufacture of soft drinks both locally and imported where a levy will be imposed on manufacturers who contravene set standards of sugar composition in soft drinks.

“Most popular soft drink brands in other countries that are similar to the ones we consume here taste very different with low sugar levels but that’s not the case in Kenya, why?” MP Kitur questioned.

The levy will be applied to manufacturers and importers of sugar- sweetened beverages where the set base is 4g/100ml which is exempt from tax while any additional gram above the set base attracts levy where locally manufactured beverages will attract a rate of ksh. 1 per g/100ml above the set base, while imported beverages will attract a rate of ksh. 2 per g/100ml beyond the set base.