The recent announcement of a 10% base tariff on all imports except those compliant with the United States-Mexico-Canada agreement (USMCA) has sparked confusion and concern among many.

Tariffs are designed to make imported goods more expensive, thereby encouraging consumers to buy domestic products instead. The US government is implementing a 10% tariff on all imports, except those from countries that have signed and ratified the USMCA.

This means that goods from countries like China, India, and the European Union will be subject to the new tariff.

The reciprocal tariff, on the other hand, is a tariff imposed on goods exported from the United States to other countries. This tariff is designed to retaliate against other countries that impose tariffs on American goods.

The US government has announced that the reciprocal tariff will be approximately half of the tariff imposed by the other country. This means that if a country imposes a 20% tariff on American goods, the US will impose a 10% tariff on goods imported from that country.

The European Central Bank (ECB) is keeping a close eye on the unfolding trade war, with President Christine Lagarde acknowledging the potential negative impact on the global economy. While the ECB is still working towards its 2% inflation target, the uncertainty caused by U.S. trade policies has prompted policymakers to consider pausing further interest rate cuts.

Bloomberg reports suggest that the ECB is concerned about the ripple effects of the trade tensions, which could disrupt global supply chains, dampen investment, and ultimately weigh on economic growth. This uncertainty makes it difficult for the ECB to accurately assess the economic outlook and therefore, to make informed decisions about monetary policy.

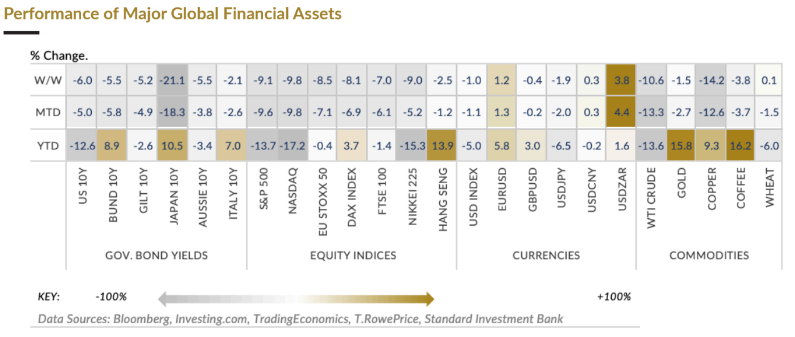

Global Markets Equities

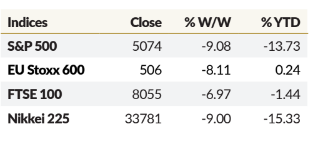

The U.S. stock market experienced a brutal week, with the escalating trade war casting a dark cloud over investor sentiment. The sell-off intensified on Friday after Federal Reserve Chair Jerome Powell issued a stark warning, suggesting the economic fallout from the trade war could be more severe than previously anticipated.

This amplified existing trade war anxieties, leading to further market declines. According to a report done by Dan Murage, portfolio analyst – global markets, at Standard Investment Bank, the S&P 500 index suffered a steep 9% loss for the week, while the Dow Jones Industrial Average plunged over 3,200 points.

The tech-heavy Nasdaq Composite also took a hit, dropping 9.77% and reaching its lowest levels since last August. Powell’s warning served as a stark reminder of the potential economic damage, prompting investors to reassess their risk appetite and seek safer havens.

The Euro Stoxx 600 index, a benchmark for European stocks, suffered its most significant decline in five years, plummeting 8.11% in dollar terms. This dramatic drop reflects the deep-seated anxieties surrounding the escalating trade war and its potential impact on the European economy, which is already facing significant headwinds.

The trade war’s impact on Europe is multifaceted. Firstly, the region’s export-oriented economies are highly vulnerable to disruptions in global trade flows. Secondly, the uncertainty surrounding the trade war’s trajectory is dampening business investment and consumer confidence, leading to slower economic growth.

‘’ It remains to be seen what the effects will be to the European, African and the global economy since we are yet to ascertain which tariffs will stick, and which will be escalated as is the case with China.’’ Dan Murage added when asked about the effects of the tariff wars on other continents.

‘’Frontier and emerging markets will be negatively impacted in the near term since investors rush to safe haven assets in more developed economies in such times of panic. However, this can provide great opportunities to take up assets that are still fundamentally strong but are trading at a discount at this point in time.’’ He added.

Rocket Companies’ stock surge this week, fueled by a remarkable 18% rally, highlights the company’s aggressive growth strategy and its ambitious foray into the mortgage market. This surge was driven by the news of two significant acquisitions: Redfin, a leading real estate brokerage, and Mr. Cooper Group, a major mortgage servicer.

The acquisition of Mr. Cooper Group is particularly noteworthy. The combined entity will manage over $2.1 trillion in loan volume, representing approximately one-sixth of all mortgages in the United States. This acquisition positions Rocket Companies as a dominant force in the mortgage industry, controlling a significant portion of the market and creating a powerful platform for future growth.

The deal, expected to close later this year pending regulatory approval, is an example of vertical integration. By acquiring both a real estate brokerage and a mortgage servicer, the company aims to control the entire homeownership journey, from searching for a property to securing financing and managing the mortgage.

Global Treasuries

It was a week of jitters in the financial world. Investors, spooked by the escalating trade war, were scrambling for safety, pushing the U.S. 10-year Treasury yields below 4% for the first time since October. It felt like everyone was holding their breath, waiting for the next shoe to drop.

The trade war had already taken a toll on the global economy, with the U.S. and China slapping tariffs on each other’s goods. But the tension escalated further when China retaliated against the latest round of U.S. tariffs, vowing to fight “till the end.”

They imposed a reciprocal 34% levy on U.S. goods, sending a clear message that they were not backing down. On Wednesday, 9th April, the US retaliated by imposing an additional 50% tariff on China unless it withdrew its retaliatory levies on the US, taking the US duties on Chinese goods to 104%. China decided to hit back by raising additional duties on American products to 84%.

Adding to the gloomy atmosphere, the manufacturing sector in the U.S. was showing signs of strain. The PMI data revealed that the sector had contracted for the second month in a row, a worrying sign for the overall economy.

The Fed Chair, Jerome Powell, weighed in, expressing concerns about the potential impact of tariffs on the economy. He emphasized the need to protect against inflation, a growing concern as the trade war disrupts supply chains and pushes prices higher.

The trade war wasn’t just a battle of tariffs; it was a global game of economic chess, with every move triggering a chain reaction of responses and consequences. The ripple effects were felt across the Atlantic, where French President Emmanuel Macron urged companies to pause U.S. investments, a clear sign of the growing unease.

The European Commission, too, was gearing up for countermeasures, signaling their determination to protect their interests. The markets were reacting with a sense of urgency, pricing in a greater than 90% chance of a 25 basis points rate cut by the European Central Bank (ECB) in April.

This move, aimed at stimulating the European economy, was a reflection of the growing concerns about the trade war’s impact. The deposit rate was expected to fall to 1.8% by December, a significant drop from earlier forecasts of 1.9% and the current 2.5%.

Across the globe, investors sought safety in the face of uncertainty. Japanese 10-year bond yields plummeted by over 20% from the previous week’s close, as investors flocked to safer assets.

‘’In a war, there are generally very few winners if any. The winners and losers can only be seen once there is more certainty on which tariffs will actually stick in the long run. Countries with bigger trade surpluses with the U.S. stand to lose more than those that have trade deficits with them but of course there may be some goods/resources that will be readily taken up by another country in the absence of the U.S.’’ Dan Murage concluded.

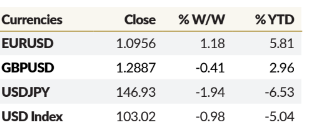

Global Currencies

The Japanese Yen rallied to by just under 2% against the U.S. Dollar driven by a global flight to safety and a weaker Dollar, highlighted the escalating trade tensions. The announcement of a 24% tariff on Japanese exports to the U.S. further fueled this trend, pushing investors towards safer assets.

Despite the global uncertainties, the Bank of Japan (BOJ) remained committed to its path of gradual rate hikes.

However, the trade war’s impact on the global economy has cast a shadow over this outlook. BOJ Deputy Governor Shinichi Uchida acknowledged the ongoing monitoring of tariffs and emphasized that further rate hikes would only be considered if the economy performs as expected.

The U.S. Dollar Index edged higher, above the 103 mark, hovering near its weakest point in six months as traders grappled with conflicting signals. Stronger-than-expected U.S. employment data provided a glimmer of optimism, but the intensifying trade war continues to weigh on sentiment.

The market is now pricing in a 50% chance of four 25 basis point rate cuts this year, up from three earlier in the week, with the first cut expected in June.

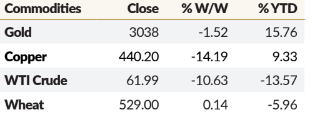

Global Commodities

Oil prices plummeted to a three-year low this week, driven by mounting fears of a global economic slowdown fueled by the escalating trade war. WTI crude futures closed at $62 per barrel, the lowest level since April 2021, representing a 9.83% weekly decline.

The escalating trade war, particularly China’s 34% tariff on U.S. goods, has rattled investor sentiment, raising concerns about weakening global demand for oil. Adding to the pressure, OPEC+ has ramped up plans to boost output by 411,000 barrels per day, further intensifying supply-driven pressures.

Copper prices also took a significant hit, falling over 14% week-on-week. Increased recession fears in the U.S. and other key global markets prompted traders to scale back their demand expectations for the metal. The market turmoil also led to traders unwinding profitable positions, contributing to a decline in Gold Futures prices for the week.