The National Assembly Public Accounts Committee (PAC) has faulted the National Police Service (NPS) and its contracted insurer Britam Insurance over delays in settling group life insurance claims owed to families of officers who have lost their lives in line of duty.

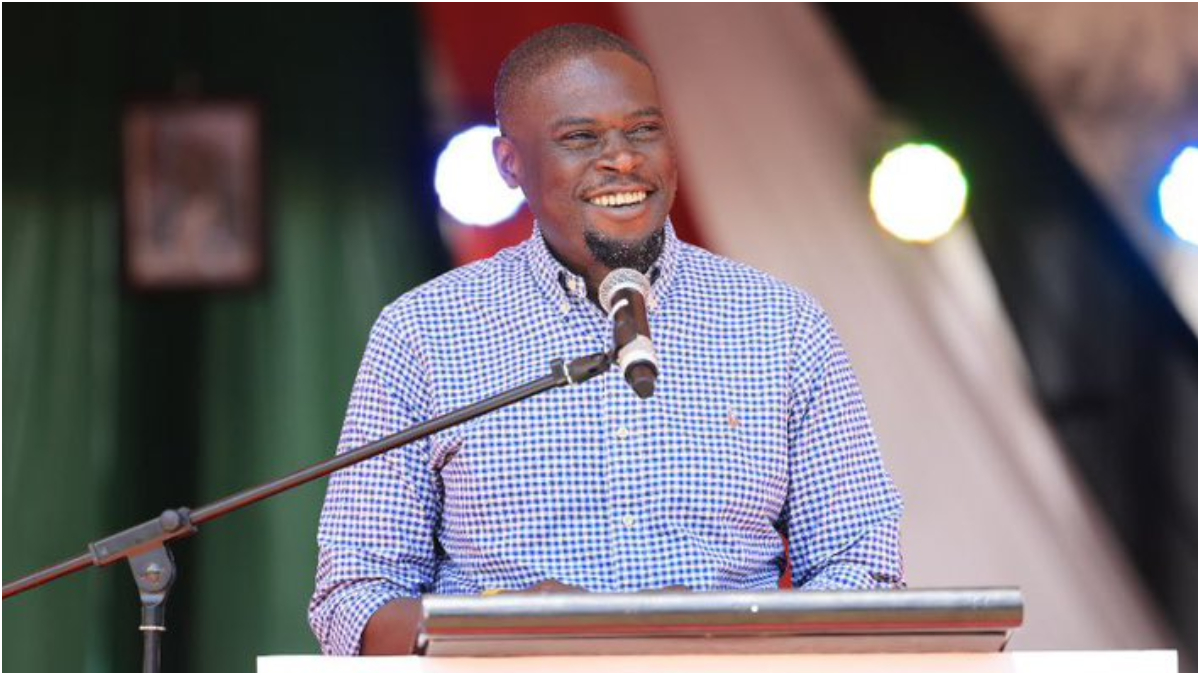

The committee, chaired by Butere MP Tindi Mwale, raised concern after the Auditor-General’s report for the financial year ended June 2023 flagged unpaid group life benefits totaling to KSh220 million contrary to contract timelines that require claims to be paid within days after full documentation is submitted.

Appearing before the committee at Parliament Buildings, the NPS team led by Ms Bernice Sialaal Lemedeket acknowledged the audit queries, but told lawmakers that progress had since been made in settling the claims following sustained pressure from Parliament.

Ms. Lemedeket told the committee that as at November 2023, Britam had not yet paid Ksh 220 million in respect to the group Life Sum Assured. Out of these, 96 cases amounting to KSh205 million have been fully settled, three cases amounting to KSh6 million are in the processing stage.

In addition, two cases amounting to KSh3.4 million were settled by KRA since the officers were on secondment at the time of death.

However, MPs said the figures did not address the deeper problem of delays which, according to the committee, had caused unnecessary suffering to bereaved families.

Aldai MP Maryanne Kitany questioned why settlement was taking years, yet premiums are expected to be paid promptly once contracts are awarded.

“The loss alone is devastating, more so when the police officer died in the line of duty, yet settlement is taking too long, while premiums were paid,” she lamented.

Mathioya MP Edwin Mugo was particularly critical of the explanation that some cases were still “under processing”, citing examples where the date of loss was in 2023 but payments were being made as late as 2025.

“Three years is far too long while this money can help the families educate children and deal with other needs,” he questioned.

Committee members demanded to know whether the insurer was complying with the service level agreement (SLA), and why claims were not being settled within the timelines provided for in the contract.

Teso South MP Mary Emase said while it was commendable that most of the flagged amount had been paid, the Auditor-General’s figure could represent only a fraction of what officers’ families were still owed.

The NPS team said delays were sometimes caused by funding constraints, citing exchequer challenges that affect timely payment of insurance premiums.

Ms Lemedeket told the committee that the police service requires stronger budgetary support to ensure insurance obligations are paid on time.

She also said the NPS was reviewing internal processes to improve efficiency and ensure officers or families submit documentation promptly, noting that some claimants do not respond when required to finalise processing, an explanation that did not sit well with lawmakers, with Funyula MP Dr. Wilberforce Oundo launching a stinging rebuke.

“This situation reflects failure by the government to protect officers who risk their lives daily to secure the country,” the Funyula MP remarked.

Britam Manager Benard Murage, who appeared alongside NPS officials, acknowledged that premium payments were central to efficient operations, describing insurance as a “cash-and-carry” business model where claims are easier to settle when premiums are up to date.

However, MPs insisted that delays had also been worsened by what they described as an insurance industry culture of dragging claims, even for ordinary citizens.

Mwale argued that insurers often withhold payments even in private policies such as comprehensive motor vehicle insurance, leaving clients frustrated and financially strained.

The committee further urged NPS and Britam to adopt innovations to help officers submit and track claims faster, including mobile-based systems, digital uploads and user-friendly platforms.