Where the Next Ksh 10,000 Should Go

Six months ago, we did a little experiment. Take 10,000 shillings, sprinkle it across three Nairobi Securities Exchange counters; KenGen, Kenya Power, and Kenya Reinsurance and then… do nothing. No clever trading strategies, no insider tips, just buy, sit, and wait.

At the time, the math suggested you’d end up with about 12,081 shillings if everything went according to plan. That was the spreadsheet talking. Yesterday’s closing prices told a different story: the portfolio climbed to 13,595.

Breaking down the Ksh 10,000 Gains

Kengen

KenGen was the reliable one. You put in 4,000 shillings at 7.12 per share, got about 562 shares, and six months later they were worth 9.84 each. Gross value was Ksh 5,530. After transaction costs, the net: Ksh 5,294. This led to a profit of 1,294, a tidy 33%.

Kenya Power

Kenya Power was the drama queen. You bought 283 shares at Ksh 10.60, they closed at Ksh 14.95, and suddenly your Ksh 3,000 had turned into Ksh 4,053 after costs. A Profit of 1,053. That’s 36%. For a company that investors used to treat like a punchline, that’s not bad.

Kenya Re

Kenya Reinsurance was the quiet star. You picked up 1,395 shares at Ksh 2.15, they closed at ksh 3.18, and your Ksh 3,000 became Ksh 4,248 after costs. Profit: 1,248. That’s 43%. Insurance is boring until it isn’t.

Add it all up: 10,000 became 13,595. Profit: 3,595. Return: 36%. The spreadsheet said Ksh 12,081, the market said “hold my beer.”

Where to Put the Next Ksh 10,000

Markets are forward‑looking, so the real question is: where do you put the next 10,000?

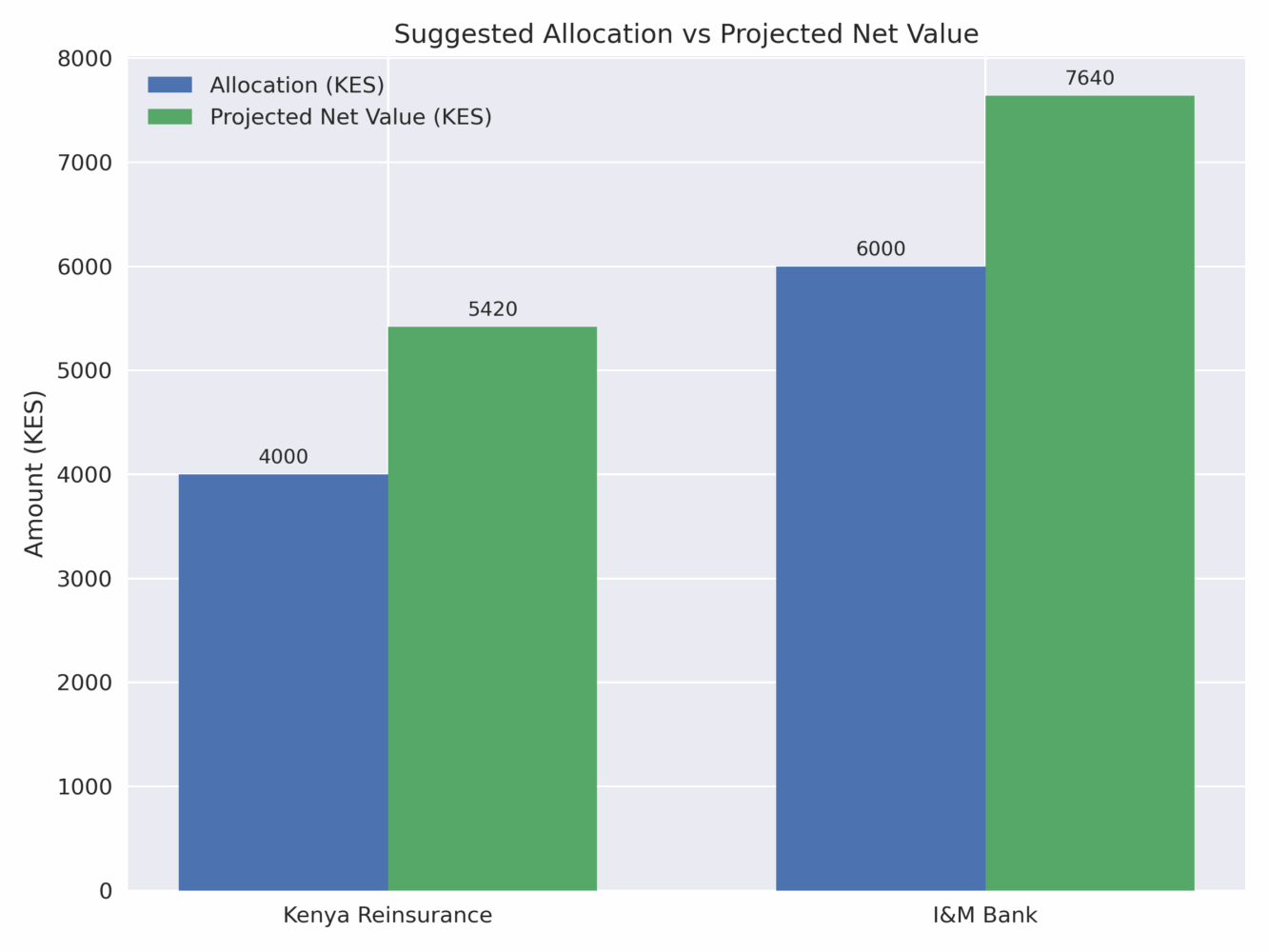

Kenya Reinsurance still looks undervalued. At 3.18, the price doesn’t reflect the company’s fundamentals. With a target of 4.50, balance sheet resilience and dividend history suggest more upside. A 4,000 shilling allocation could grow to about Ksh 5,400 net.

I&M Bank is another play. Trading at 45.00, below book value, it’s basically selling for less than the bricks cost. With a target of 60.00, strong capital adequacy and regional expansion plans make this a classic value investor’s pick. A 6,000 shilling allocation could grow to about Ksh 7,600 net.

These projections are neat, tidy, and look great in a chart. But markets are not neat, tidy, or chart‑friendly. Infact, they are moody. They move for reasons that make sense only after the fact or sometimes not at all. So yes, the math says 13,060, but the market might just shrug and say “nah.” In other words: don’t confuse arithmetic with certainty.