A petition has been filed in court seeking to stop the Government of Kenya from selling 15% of its shares in Safaricom PLC to a private foreign entity, a move described by the petitioner as a threat to national security, data sovereignty, and the public interest.

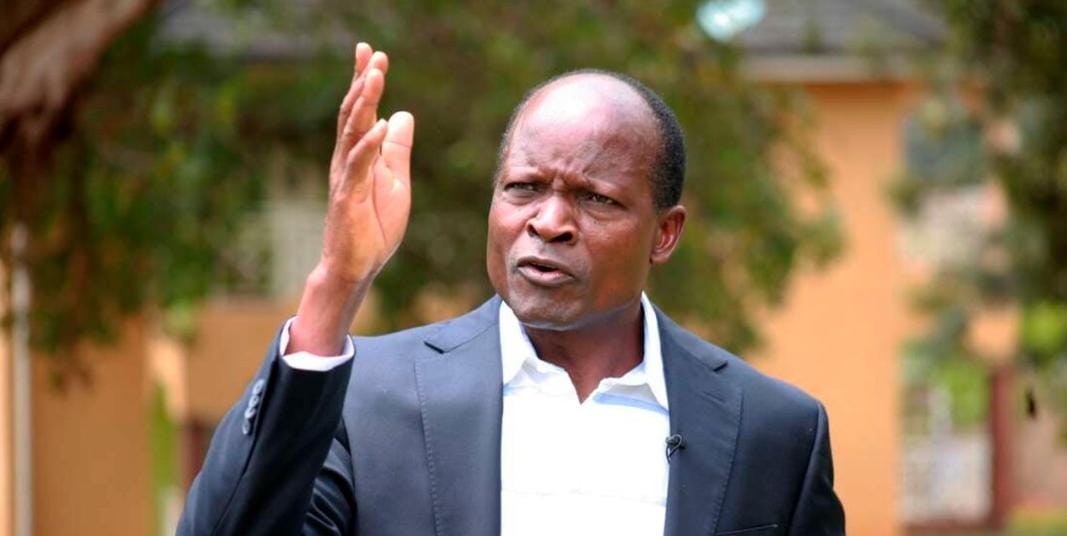

The petitioners, Tony Gachoka and Prof. Fredrick Ogolla , in an urgent application, argues that the proposed sale would reduce the Government’s stake from 35% to 20%, weakening its control over the company and leaving it with only two board seats.

“The 6th Respondent-Safaricom dominates more than half of Kenya’s mobile telecommunications connections, mobile money, e-commerce, and digital financial services. It is a strategic national asset that cannot be carelessly transferred to a foreign entity,” Gachoka stated in his affidavit.

The petition claims that the sale, valued at approximately KSh 204.3 billion or Kshs. 34 per share, is grossly undervalued compared to the estimated intrinsic value of KSh 70–80 per share, potentially exposing the Kenyan public to losses of over KSh. 250 billion.

“This transaction has been rushed, opaque, and non-competitive. There has been no meaningful public participation, no independent valuation, and no risk assessment. It is procedurally dubious and injurious to the people of Kenya,” Gachoka said.

The affidavit further contends that the Government’s attempt to dispose of these shares under the Public Private Partnerships Act, 2022, bypasses the requirements of the Public Procurement and Asset Disposal Act, 2015, and the Privatization Act, 2025.

“The Public Private Partnerships Act cannot override constitutional principles of transparency, accountability, and good governance. The law is clear: disposal of public assets must follow strict statutory processes and be subjected to public scrutiny,” the affidavit reads.

Gachoka also warns that the sale threatens Kenya’s strategic leverage over critical infrastructure.

“If the 7th Respondent-Vodacom Group acquires the shares, it will hold 55% control over the sector. The Government will be left with only 20%, undermining control over mobile money systems, competition policy, and sensitive national data infrastructure,” they argued.

The petition raises additional concerns, noting that the transaction contains no safeguards for data localization, protection of financial information of over 30 million Kenyans, or national security impact assessments.

It also criticizes proposals to channel proceeds into an infrastructure fund managed solely by the Cabinet Secretary, warning of “concentration of financial power, evasion of parliamentary oversight, and collapse of accountability.”

The court has been asked to issue conservatory orders restraining the Government and other respondents from transferring, selling, or disposing of the shares pending full determination of the case.

The petitioners also seeks full disclosure of valuation reports, approvals, advisors involved, and all related agreements.

“This is not just about a financial transaction; it is about protecting a strategic national asset and ensuring the Kenyan public is not short-changed,” Gachoka and Prof. Ogolla emphasized.