You are sitting with a crisp KES 10,000, asking the million-shilling questions: Where should I invest? What’s secure? Where’s the upside? And how do I start?

The Nairobi Securities Exchange (NSE) just made it easier to start. You no longer need to buy a minimum of 100 shares to get on the normal trading board. Now? You can invest in just one share-no need to be a baller to be a shareholder.

So, how can you turn that 10K from spare change into strategic growth?

Short-term investors in the Stock Market

Short-term investors typically hold stocks for a few days to a few months, aiming to capitalize on quick price movements.

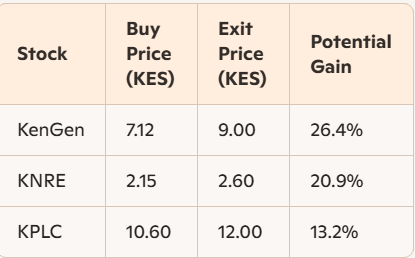

Let’s say you decide to invest KES 10,000 in the stock market, spread across three companies: KenGen, KNRE, and KPLC.

To maximize gains, you allocate more to the stock with the highest expected return.

You put KES 4,000 into KenGen, whose share price is KES 7.12. With that amount, you buy about 562 shares. If the price rises to KES 9.00, your shares would be worth around KES 5,058. That’s a profit of KES 1,058 from KenGen alone.

Next, you invest KES 3,000 into KNRE, buying shares at KES 2.15. That gives you around 1,395 shares. If the price reaches KES 2.60, your shares would be worth about KES 3,627, earning you a gain of KES 627.

The final KES 3,000 goes into KPLC, where the share price is KES 10.60. You get roughly 283 shares. If those shares climb to KES 12.00, they’ll be worth around KES 3,396. That’s another KES 396 in profit.

Add up all your gains:

- KES 1,058 from KenGen

- KES 627 from KNRE

- KES 396 from KPLC

Total Gains = KES 1,058 + 627 + 396 = KES 2,081

Your total profit is KES 2,081, meaning your initial KES 10,000 could grow to KES 12,081, assuming all target prices are met.

Upside

- Minimised risk through diversification

- Easy and fast gains

- Swings are good, only, you need to be timely on Entry and Exit.

How to get started

Open a CDSC account, choose a licensed stockbroker or investment bank and start trading!