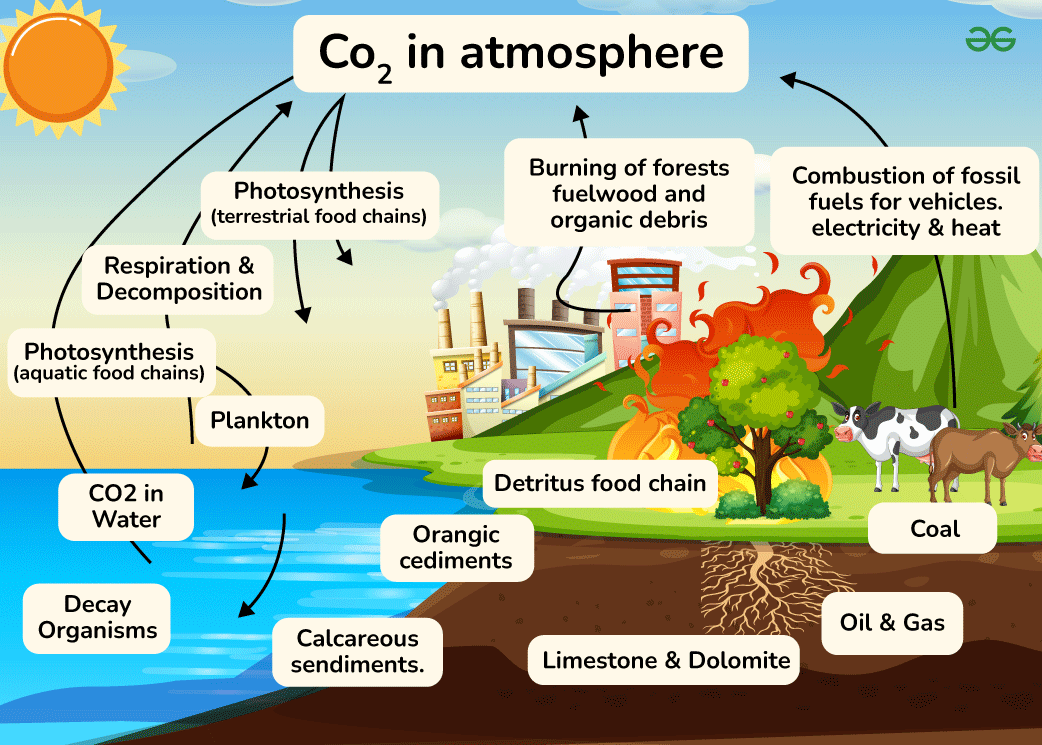

Carbon is the building block of life, forming the basis of everything from our bodies to the trees we see around us. Carbon dioxide, a gas containing carbon, is naturally present in the atmosphere. It acts like a blanket, trapping heat and keeping our planet warm enough to sustain life. However, human activities, like burning fossil fuels like oil, and natural gas for energy, transportation, and industrial processes. Carbon emissions are also released from deforestation, agricultural practices, and waste management, are releasing massive amounts of carbon dioxide into the atmosphere, disrupting this natural balance.

Carbon emissions are indicated in air flight tickets, product labels, food menus and companies sustainability reports. These emissions do not only affect the natural balance, but also affects the individual’s health, the economy and can lead to displacement and migration.

China currently leads the world in carbon emissions accounting for 27% followed by the United States at 14%, India at 7%, Russia at 5% and Japan at 3%. To address this crisis, carbon emissions must be reduced. This is where carbon markets come in. Carbon markets are a system that puts a price on carbon emissions, creating a financial incentive for companies to reduce their environmental impact.

The European Union has a well-established carbon market, with a system of emissions allowances for industries like power generation and aviation. China has a national carbon emissions trading scheme, launched in 2021, California has a cap-and-trade program, which has been credited with reducing greenhouse gas emissions in the state, Australia has a carbon pricing mechanism in place, which has been credited with reducing emissions in the country’s energy sector and South Korea has a national emissions trading scheme that covers a wide range of industries.

The Paris agreement, a landmark deal aimed at tackling climate change, has set goals for reducing greenhouse gas emissions. Achieving these goals requires international cooperation, and one key mechanism for achieving this is article 6. Article 6 focuses on the transfer of carbon credits between countries. These credits represent reductions in greenhouse gas emissions, allowing countries that have exceeded their emissions targets to buy credits from countries that have reduced their emissions below their targets. Companies that reduce their emissions below a certain limit can sell their carbon credits to companies that exceed their limit. This system creates a global market for carbon emissions, incentivizing countries to invest in clean technologies and sustainable practices.

It may not be possible to eliminate all our carbon emissions, but we can compensate them through carbon offsets. Carbon offsets work in tandem with carbon credits and carbon markets to provide a comprehensive approach to reducing greenhouse gas emissions. Dave Rouse, CEO of carbon click explains the different kind of solutions citing nature based solutions and engineered solutions as the major ways to compensate carbon emissions.

Financial instruments play a crucial role in carbon offsets by facilitating the financing, trading, and verification of emission reduction projects. These instruments enable the mobilization of capital to support projects that generate carbon offsets, such as renewable energy installations, reforestation initiatives, and energy efficiency improvements.

Another key financial instrument is the carbon offset credit, which represents one metric ton of carbon dioxide equivalent (CO2e) reduced, removed, or avoided. These credits are generated by projects that meet specific standards and are verified by third-party organizations to ensure their environmental integrity.

In the carbon market, carbon offset credits are traded. This market provides a platform for buyers and sellers of carbon offsets to interact, enabling companies and individuals to offset their emissions by purchasing credits from projects that reduce greenhouse gas emissions.

Furthermore, financial instruments such as bonds, loans, and equity investments are used to fund carbon offset projects. These instruments provide the necessary capital for project developers to implement emission reduction activities, thereby generating carbon offsets.

”’Pricing is really a supply and demand in market led situations” emphasized Dave on how carbon pricing works. Carbon pricing is a mechanism that assigns a cost to carbon emissions, typically in the form of a carbon tax or a cap-and-trade system. This cost reflects the environmental and social costs associated with emitting greenhouse gases, such as climate change impacts and air pollution.

Carbon pricing allows carbon markets to work effectively by creating a financial incentive for emission reductions. In a cap-and-trade system, for example, a limited number of emission permits are issued, and companies must either reduce their emissions or purchase permits from those who have reduced their emissions. This creates a market for carbon credits, where the price of the credits reflects the cost of reducing emissions.

By channeling the revenue generated from carbon pricing into climate-resilient infrastructure, clean energy initiatives, and social safety nets, African nations can unlock sustainable development pathways. This influx of funds can attract further investment, foster innovation, and create green jobs, accelerating the transition to a low-carbon economy.

Carbon pricing can incentivize the private sector to invest in climate-friendly projects, thereby reducing reliance on external financing and fostering economic self-sufficiency. Ultimately, the effective implementation of carbon pricing strategies offers a viable solution to bridge the financing gap, empowering African countries to achieve their sustainable development goals and build a prosperous, climate-resilient future.