Israel-Iran war

In the words of Smedley Butler, “War is a racket,” the true beneficiaries of conflict are often a small group, while the majority endures the suffering. This reality is further illuminated by the fact that, in politics, nothing happens by accident. The recent escalation of geopolitical tensions, where violence disrupts trade, as it is the “natural enemy of trade,” highlights this.

The principle that “He who controls the spice controls the universe” underscores the high stakes. This week, the spotlight shifted from trade policy uncertainty to escalating geopolitical tensions as Israel initiated unilateral attacks within Iran.

Despite mounting concerns about a potential Israeli strike on Iran—intended to halt the development of a nuclear weapon—diplomatic solutions were still hoped for. The precise moment of the attack remains a mystery. The immediate outcome was a surge in oil prices, which further destabilized an already fragile global economy.

In the immediate aftermath, these elevated oil prices translate into heightened inflationary pressures, which, in turn, dims the prospects for global economic growth. This situation adds another layer of complexity and uncertainty to the intricate balancing act that global central bankers must navigate.

The increase in oil prices directly impacts various sectors. Higher energy costs increase production costs for businesses, which often pass these costs on to consumers, leading to a rise in prices for goods and services. This, in turn, diminishes consumer purchasing power, potentially leading to decreased spending and slower economic activity.

Simultaneously, central bankers face a dilemma. They must balance the need to control inflation with the need to support economic growth. Rising inflation might prompt them to raise interest rates to cool down the economy. However, this can also make borrowing more expensive, which could further slowdown economic activity.

The delicate task for central bankers is to find the right balance to stabilize the economy without causing a recession. Moreover, the geopolitical instability surrounding the attack adds another layer of uncertainty. Investors may become hesitant, leading to market volatility. This uncertainty could lead to decreased investment and further hinder economic growth.

EQUITIES

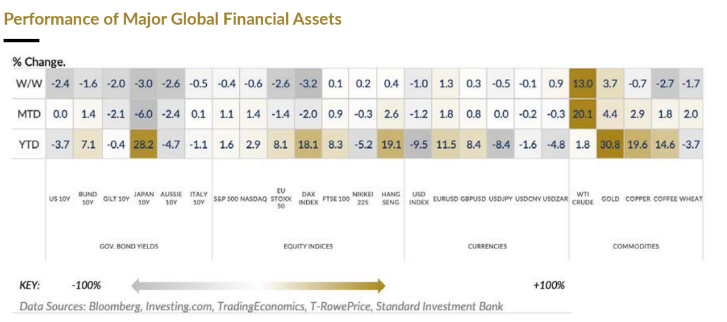

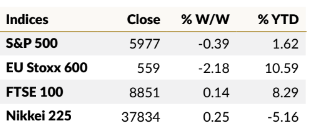

The heightened tensions resulting from the escalation of the Israel-Iran conflict significantly impacted market sentiment. It caused both U.S. and European indices to reverse their gains and close the week in negative territory. The atmosphere of uncertainty and fear led investors to seek safer investment options, causing a broad sell-off in riskier assets.

According to a report done by Dan Murage, portfolio analyst, global markets at Standard Investment Bank, the S&P 500, a key benchmark for the overall market, declined by 0.39%. The tech-heavy Nasdaq Composite, which is often more sensitive to shifts in investor sentiment, fell by a more significant 0.6%. The Dow Jones Industrial Average, an index of 30 major companies, saw a substantial drop, shedding 1,401 points.

This decline reflects a broad-based retreat from the market as investors grew increasingly concerned about the potential economic consequences of the escalating conflict. This “flight to safety” manifested in several ways. Investors moved their capital towards assets considered less risky, such as government bonds, gold, and the U.S. dollar. These assets are often seen as safe havens during times of geopolitical instability because they are perceived to be less vulnerable to economic shocks. The shift in investment preferences put downward pressure on stock prices, contributing to the overall market decline.

Asia

Despite the prevailing negative sentiment in global markets, the Hang Seng Index showed resilience, managing to end the week on a positive note. The index’s 0.4% gain, closing at 23,893 on Friday, marked a second consecutive week of gains. This performance was particularly noteworthy given the broader market downturn, which was largely triggered by Israel’s strike on Iran, leading to widespread sell-offs and risk aversion among investors.

The index benefited from signs of improving relations between China and the United States. The tentative trade agreement between the United States and China, reached in London, offers a glimmer of hope amidst the ongoing trade tensions. The White House’s announced that an agreement had been reached on access to rare earth minerals, a critical component in various high-tech industries.

Securing access to these resources is vital for both countries, particularly as they compete in the technology sector. The United States’ continued stance on tariffs, with a planned 55% charge on Chinese goods, signals that significant hurdles remain.

These tariffs, a key tool in the trade war, aim to reduce the trade deficit and protect American industries. The impact of these tariffs is already evident, with China’s exports to the United States down by 35% year-on-year as of May.

The gains in the Hang Seng were further supported by specific sector performances. Certain sectors, such as technology and consumer discretionary, which are heavily represented in the index, showed relative strength. In addition, there was a notable increase in trading volume, indicating that investors were actively participating in the market and that the gains were not simply a result of a lack of selling pressure.

COMMODITIES

Oil

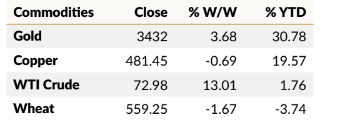

The surge in WTI crude futures, reaching just below $73 per barrel and marking a 13.01% increase by Friday’s close, reflects the market’s immediate reaction to the escalating tensions in the Middle East. The Israeli strike on Iran, and the subsequent vows of retaliation, has heightened fears of a broader conflict, directly impacting the global energy market.

This price surge represents the highest level since February, underscoring the volatility and sensitivity of the oil market to geopolitical instability. The significance of Iran’s role in the global energy supply further amplifies the market’s concerns.

April crude supply stands at 3.305 million barrels per day and any disruption to Iran’s production or export capabilities could have significant repercussions. The Middle East, as a whole, is a critical region for global energy, and any escalation of conflict could lead to supply chain disruptions, pushing prices even higher.

The market is now heavily focused on the potential for further escalation and the possible impact on oil production and transportation routes. Beyond the immediate price jump, the situation raises several key considerations.

Firstly, the sustainability of the price increase will depend on the unfolding events and the extent of any military or economic actions. Secondly, the reaction of other major oil-producing nations and their willingness to increase production to offset any potential supply shortfalls will be crucial. Finally, the potential for economic sanctions and their impact on Iran’s oil exports could significantly alter the supply-demand dynamics.

Gold

The slight easing of gold prices below the $3,400 per ounce mark, with the bullion currently trading at $3,389.95, suggests a degree of cautious optimism emerging in the market. This price correction coincides with reports indicating that Iran is open to de-escalation. Such a development would lessen the immediate threat of a broader conflict, thereby reducing the demand for safe-haven assets like gold.

CURRENCIES

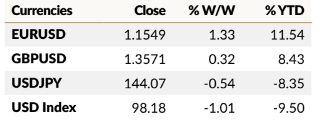

The U.S. Dollar’s rebound to 98.18 on Friday, after dropping to multi-year lows, underscores its safe-haven status during escalating geopolitical tensions in the Middle East. Investors, seeking security amidst uncertainty, often turn to the dollar, which strengthens its value.

The fact that the dollar is considered a safe haven is a direct reflection of the market’s fear and the desire to protect capital in a volatile environment. However, several factors are weighing on the dollar’s strength.

Growing uncertainty surrounding President Trump’s trade policies, including the renewed threat of unilateral tariffs, is causing concern. Such trade actions could disrupt global markets and potentially harm the U.S. economy, which could weaken the dollar.

Additionally, softer-than-expected consumer and producer inflation data have reinforced expectations for further interest rate cuts by the Federal Reserve. Lower interest rates can make the dollar less attractive to investors, as they seek higher returns elsewhere.

The Swiss Franc’s performance further highlights the flight-to-safety sentiment. Trading at 0.81121 per USD on Friday, nearing its 2011 highs. Aside from this several factors contribute to the Swiss franc being up 10.52% for the year, including broader market uncertainties like US economic and fiscal outlook. The Swiss National Bank may reintroduce negative interest rates by cutting its key rate this coming week.