The Finance Bill, 2025 has been officially referred to the Departmental Committee on Finance and National Planning for consideration.

National Assembly Speaker Moses Wetangula, in a notice issued on Monday, May 12, confirmed that the Bill had been designated as a priority and will be considered considered when the House resumes its sittings on May 27, 2025.

“… the Committee is to expeditiously consider the Bill and submit its report upon resumption of regular Sittings of the House… upon resumption of the House, the House Business Committee shall expedite consideration of the Finance Bill (National Assembly Bill No. 19 of 2025); and, the Clerk is hereby required to transmit this Notification to all Members of the National Assembly, and facilitate the Committee to undertake the necessary public participation activities on the Bill.”

Key highlights

The FY2025/26 Budget faces significant financing challenges, with total projected revenues revised downward to KSh3,316.9 billion (17.2% of GDP), compared to KSh3,383 billion (17.6% of GDP) in the 2025 Budget Policy Statement (BPS).

This includes ordinary revenue of KSh2,757 billion (14.3% of GDP) and Appropriations-in-Aid (AiA) of KSh559.9 billion (2.9% of GDP), reflecting an upward revision of KSh11.1 billion in AiA.

The reduced revenue projections highlight limited opportunities for introducing new taxes while expenditure pressures continue to rise.

The Bill seeks to achieve various objectives like tax incentives, which have not met their intended objective of driving broad economic growth. Instead, these incentives have disproportionately benefited specific businesses or sectors, leading to inflated profit margins and creating inequities and distortions within the tax system.

Gratuity gains tax relief

The Finance Bill, 2025, clears the air by making gratuity payments tax-exempt, ensuring that all retirement benefits, including pension and gratuity, are treated equally under the new Exempt-Exempt-Exempt (EEE) regime, empowering employees to keep more of their hard-earned money for a secure future.

Amendment to section 5: Tax-free per diem benefits

The Bill proposes to increase the tax-free per diem limit for private sector employees from KSh2,000 to KSh10,000 per month for out-of-town work.

This aligns with public sector practices and follows the 2024 amendment that raised the exemption for non-cash benefits, aiming to boost employees’ disposable income.

VAT changes and enforcement

There are major clean-ups on the VAT side, where the Bill is proposing to expunge the following from the Second Schedule of the VAT Act (Zero-Rated)to the First Schedule (Exempt):

- Inputs or raw materials (either produced locally or imported) are supplied to pharmaceutical manufacturers in Kenya for manufacturing medications,

- Transportation of Sugar from Farms to Milling Factories,

- The supply of locally assembled & manufactured mobile phones,

- The Supply of electric bicycles,

- The Supply of solar and lithium-ion batteries, and

- Inputs or raw materials locally purchased or imported, for the manufacture of animal feeds.

The Bill proposes tax on goods or services that were initially exempt or zero-rated if later used inconsistently with their intended purpose. This aims to curb abuse of VAT reliefs and protect revenue.

While it helps close tax evasion gaps, concerns remain about how fairly and transparently misuse will be determined.

Data privacy and system improvements

The Bill opens the backdoor to unprecedented data access for reviving last year’s controversial push and blurring the line between tax enforcement and data privacy, leaving businesses and individuals exposed.

Re-introduction of cabinet secretary’s powers to waive penalty and system related errors

The introduction of penalty and interest waivers for system-related errors is a positive step towards ensuring fairness and accountability in tax administration. However, while this proposal is much needed, the delayed implementation until January 2026 leaves taxpayers vulnerable to unfair charges.

This extended wait raises concerns about the trustworthiness of the system, as taxpayers continue to bear the burden of issues outside their control.

Boosting construction: Levy reduction offers lifeline to a struggling sector

A proposal to cut the Export Investment Promotion Levy from 17.5% to 10% on construction-related products like bars and rods of iron or non-alloy steel aims to revitalize the struggling construction sector.

For instance, the sector contracted by 2.0% in Q3 2024, compared to 4.0% growth in the same quarter of 2023, mainly due to budget cuts on major infrastructure projects and high costs of materials like cement and bitumen.

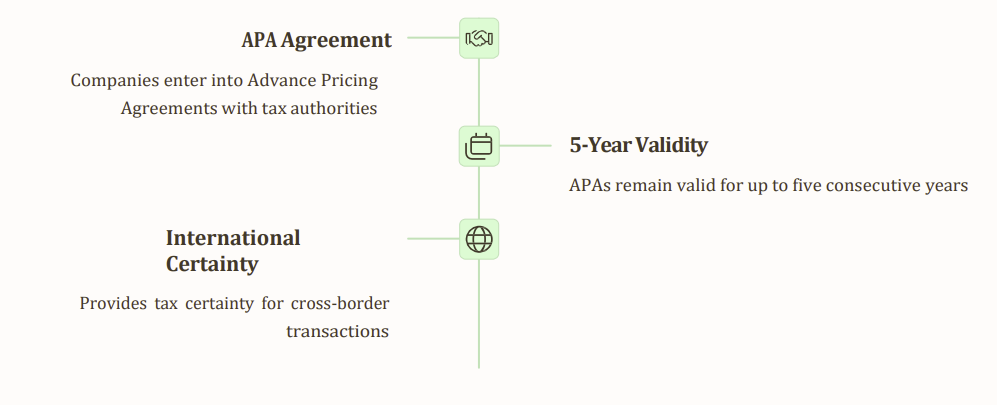

International tax measures

Advance Pricing Agreements (APAs) are making a return, salvaged from the collapse of the Finance Bill 2024. The APA will be valid for a maximum of five consecutive years, which seems like a fair duration.

With this move in the transfer pricing space, there is hope for increased certainty regarding the tax outcomes of international transactions. This should help reduce the administrative burden and costs associated with transfer pricing matters.

The Finance Bill 2025 addresses gaps left by the Tax Laws (Amendment) Act concerning the Minimum Top-Up Tax, clarifying that it will be payable by the end of the fourth month following the end of the income year.

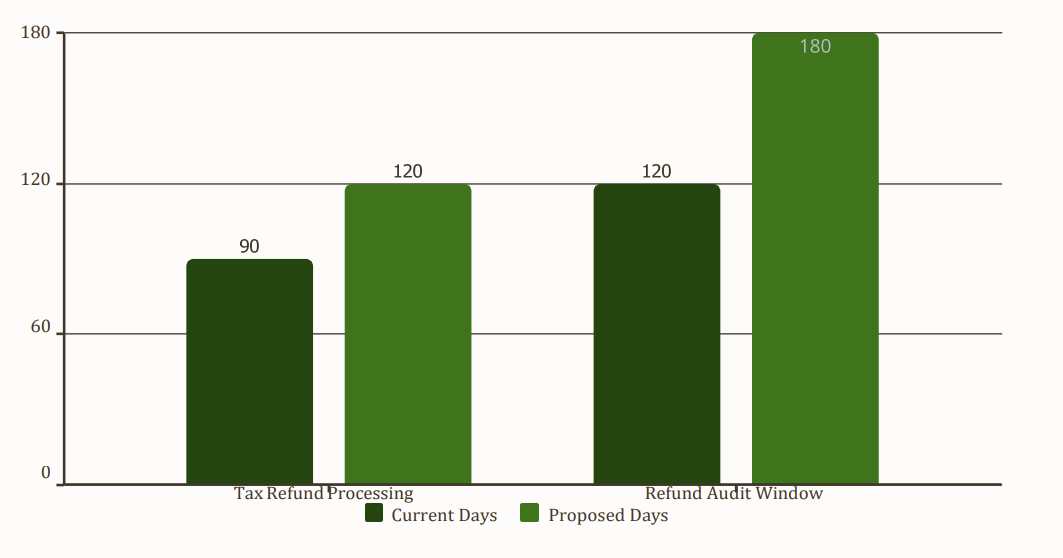

The Bill proposes to extend the Kenya Revenue Authority’s timeline for processing tax refunds from 90 to120 days, and the refund audit window from 120 to 180 days.

From the taxpayers’ cashflow perspective, these changes are likely to worsen existing delays and intensify financial strain, complicating an already challenging refund environment.

These extended timelines could significantly impact business cash flow and financial planning, particularly for companies that rely on timely tax refunds for operational expenses or investment purposes.

Tax incentives for aircraft maintenance industry

To support the growth of Kenya’s aircraft maintenance sector, the Finance Bill 2025 proposes to exempt all parts of helicopters, aircraft, and spacecraft from the Import Declaration Fee (IDF) and Railway Development Levy (RDL), making maintenance more affordable and positioning Kenya as a regional maintenance hub.

In conclusion, the Bill primarily aims to boost tax revenue collection through a combination of administrative reforms and enhanced taxpayer compliance, focusing on existing policies rather than introducing new taxes.

In line with the National Tax Policy and the Medium-Term Revenue Strategy, the Bill seeks primarily to reduce tax expenditure by streamlining tax incentives across the Value Added Tax (VAT) Act, the Income Tax Act, and the Miscellaneous Fees and Levies Act.

Additionally, the Bill proposes a more targeted approach by linking tax relief directly to actual economic activity, allowing only expenses that are directly related to generating taxable income to be deducted when calculating taxable income.