From Nairobi’s cautious optimism to Lagos’s relentless rally, African stock markets last week offered a vibrant patchwork of economic sentiment, investor behavior, and sector performance. While some bourses dazzled with bullish runs, others held firm, and a few whispered signs of hesitation.

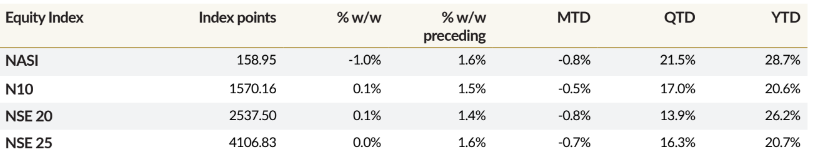

Kenya’s Stock Market

Kenya’s equities market ended the week walking a tightrope. The NSE 20 and N10 indices eked out 0.1% gains, hinting at underlying resilience. Yet the broader NASI dipped by 1.0%, reflecting cautious sentiment across the board. Trading volumes climbed to USD 21.8 million – an 8.6% increase that showcased growing investor engagement.

Still, it was Safaricom that stole the spotlight, contributing a staggering 53.4% of the week’s turnover. Its dominance, however, came with a sting: a 3.3% decline in share price dragged the stock to KES 26.00, dampening broader market enthusiasm.

Rwanda’s Stock Market

Rwanda’s stock market might have looked motionless at first glance, but the underlying numbers told a more compelling tale. Neither the Rwanda Share Index (RSI) nor the Rwanda All Share Index (ALSI) moved, staying completely flat.

Yet, turnover surged by an eye-popping 476.8% to Frw 180.9 million, fueled almost entirely by activity in I&M Bank Rwanda. With 98% of the trades concentrated in one counter, and a weighted price-to-earnings ratio of just 5.9x, the Rwandan market may be quietly preparing for a broader shift.

Malawi’s Stock Market

In Malawi, investors had something to cheer about. The Malawi All Share Index (MASI) jumped from 374,251.52 to 393,087.82 points, marking a strong rebound driven by notable gains in STANDARD, SUNBIRD, and NITL stocks. The performance suggests renewed confidence in consumer-driven and hospitality sectors, particularly as the country continues to recover from inflationary headwinds

Nigeria’s Stock Market

Nigeria’s equity market remains a master class in upward momentum. The NGX All Share Index (ASI) surged 5.07% week-on-week to close at 141,263.05 points, while the Mid-tier Equities Performance (MEP) index outpaced it with a 7.15% gain. MEP’s outperformance was powered by soaring positions in MTNN (+20.00%), WAPCO (+19.15%), and GTCO (+5.85%).

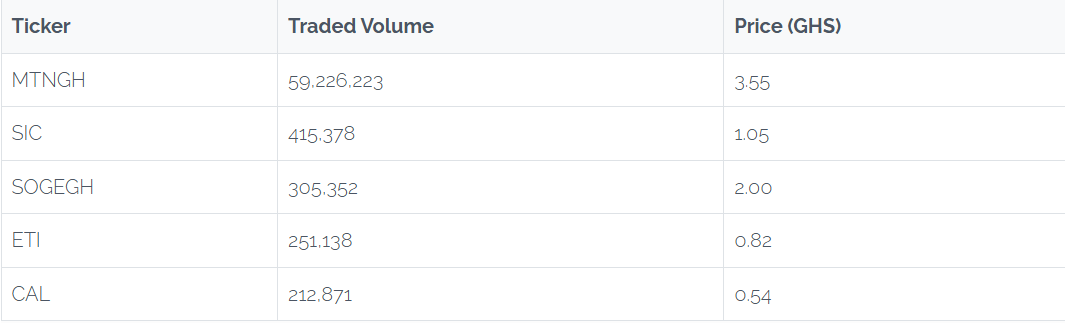

Ghana Stock Market

Over in Ghana, the mood was nothing short of bullish. The local bourse saw a dramatic spike in trading activity, with share volumes rising by 71% and traded value nearly doubling to GH₵275.42 million. Market capitalization posted a healthy 2.77% gain, rising to GH₵146.13 billion.

Meanwhile, the GSE Composite Index climbed 4.82%, adding to an already impressive 43.08% year-to-date return. Financial stocks contributed modestly, with the GSE Financial Stocks Index gaining 0.46% for the week.

Beyond the closing bell….

The Coop That Became a Capital Market

Inspired by Chuma, the trailblazing chicken who became a stockbroker the entire Nderi village coop caught the trading bug.

Egg layers pooled savings into a REIT (the Real Egg Investment Trust). Roosters went heavy on infrastructure ETFs, chicks, barely hatched, started dollar-cost averaging before cracking their shells.

Meanwhile, a startup called FeatherFlow launched an AI-powered robo-advisor tailored to agricultural profiles. Soon, the entire ward was tracking candlestick charts beside the banana trees, debating P/E ratios between pecks of feed.

FeatherFlow’s dashboard issued custom recommendations:

- Chick investors: Dollar-cost average into maize ETFs

- Roosters: Go aggressive on manure futures

- Hen retirees: Park funds in NestEgg Select, the top dividend-yielding poultry portfolio

As the movement gained steam, the Nairobi Securities Exchange took notice, listing the coop’s flagship fund: KukuSelect 25 (KU25)- an index of high-performance, poultry-backed stocks. It outperformed the NASI and boasted one of the highest retail investor confidence scores in East Africa.

But trouble was brewing in the feed tray.

Kari the broiler, KU25’s largest shareholder and a compulsive trend-chaser, had been restless. Known for his impulsive trades and late-night infomercial binges, Kari stumbled upon one pitch that promised explosive returns and “snout-to-profit sustainability” – PigSty Agritech’s MudYield X fund, a biofuel startup extracting clean energy from pig waste.

By sunrise, Kari had offloaded 40% of his KU25 holdings and plowed the proceeds into MudYield X. The coop, heavily exposed to Kari’s stake, panicked. Liquidity dried faster than spilled corn mash in July. Prices nosedived.

FeatherFlow’s dashboard lit up in crimson. Algorithms scrambled. Trade bots chirped. The coop’s ticker, KU25, bled red.

Over at Coop HQ, Ndunge, the Chief Eggonomic Strategist, reviewed the quarterlies with a heavy beak. Earnings per shell had dipped. FeatherFlow recommended a merger with the pigsty fund to stabilize yolk exposure.

She stared at the KU25 chart, adjusted her feathers, squared her beak, and muttered:

”Well, that’s the market for you. One day you’re laying golden eggs, the next day you’re the value meal.”