Equity Bank has enhanced the product by reviewing the initial 24-hour withdrawal period to the new instant withdrawal capability.

Customers can seamlessly link their PayPal account to their Equity Mobile App or Equity Online for instant withdrawals with no daily limit.

Equity Bank has announced the enhancement of PayPal withdrawals from the initial 24-hour withdrawal period to an instant withdrawal capability.

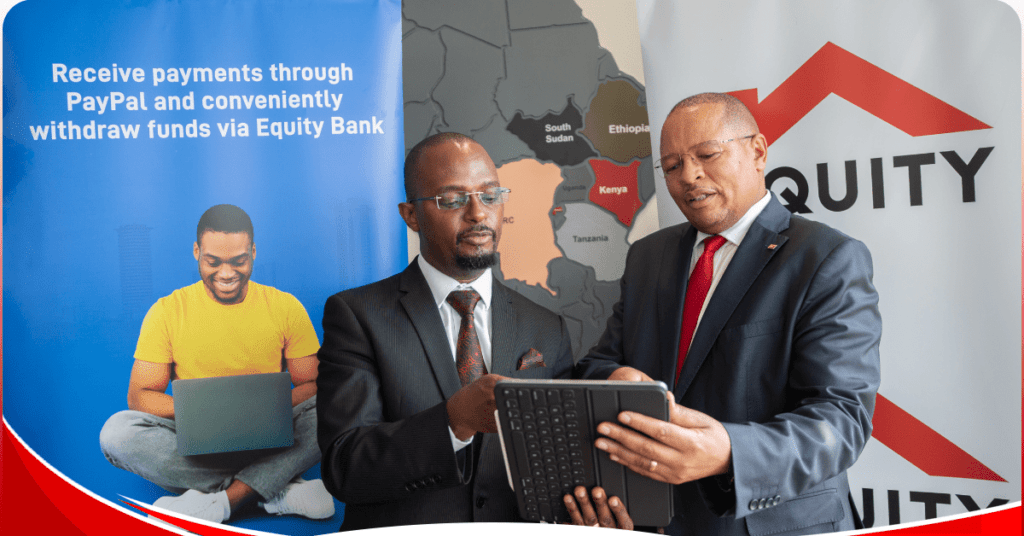

Equity and Paypal scale up services

The enhanced capability allows Equity to offer a faster PayPal settlement period for millions of customers who receive payments through the international payment solutions provider.

Equity Bank currently offers the only PayPal-to-bank withdrawal service in the country.

This enables PayPal account holders to instantly withdraw funds paid from their registered PayPal accounts straight to their Equity Bank accounts.

Moreover, the account holders can withdraw their funds in KES or USD, with transaction limits of up to USD 10,000 per transaction.

Additionally, PayPal withdrawal service is available on the Equity Mobile App and Equity Online.

ALSO READ: Former Churchill show comedian Mtumishi claims his mother practices witchcraft

Instant Paypal withdrawals

Customers can seamlessly link their PayPal accounts to their Bank accounts for instant withdrawal with no daily limit.

Commenting about the incorporation of instant withdrawal capacity, Equity Bank Kenya Managing Director Gerald Warui said: “The reduced settlement period will support businesses and individuals to better manage their cash flows more effectively.“

Warui stated, “The enhancement of the withdrawal capacity will be a major boost to local PayPal users and is in line with the fast growth of cross-border trade.”

From the Equity Mobile App or Equity online, existing PayPal customers will easily connect to the service.

This will be possible by selecting the linked PayPal account in their mobile app.

Moreover, the Equity Mobile App or Equity Online will display the updated PayPal button with the account balance on the dashboard.

ALSO READ: Senior factory manager found with 11 bags of stolen coffee in Embu

Kenya’s thriving digital economy

Speaking on behalf of PayPal, Mark Mwongela, Director of Middle East & Africa said: “Kenya’s thriving digital economy presents vast opportunities.”

“Our enhanced collaboration with Equity Bank facilitates seamless and instant withdrawal of PayPal funds, providing real-time access for millions of Kenyans,” Mwongela stated.

He shared, “This reinforces our joint commitment to supporting local digital growth and cross-border payments.”

ALSO READ: East African presidents endorse Raila for the AU commission chairperson job

Freelancers, including but not limited to digital content creators, remote workers, journalists, and photojournalists, the hospitality industry, and web-based shops involved in cross-border trade are expected to benefit from this service.

This will be made seamless due to both PayPal and Equity enabling instant access to funds.

Additionally, PayPal has remained at the forefront of the digital commerce revolution for more than 25 years.

By leveraging technology to make sending money and shopping more convenient, affordable, and secure, the PayPal platform is empowering hundreds of millions of consumers.

Merchants and consumers in more than 200 markets are set to join and thrive in the global economy.

ALSO READ: Kenya wins bid to host 2024 Transform Africa Summit for ICT